Nearside Free Business Checking: Earn Cash Back Up To 5%

Bestreferraldriver is supported by its audience. We write our articles independently but we may earn affiliate commissions when you use links on this page.

Two years into the COVID-19 pandemic that has devastated our country and economy, many small business owners face significant financial challenges, which are exacerbated by a lack of capital to sustain their businesses. A recent national survey of small business owners shows that relatively few small businesses have applied for PPP (Payment Protection Program) or other federal small business assistance services, which has highlighted the need for small businesses to identify alternative solutions to recover and grow post-pandemic.

Traditional lending is obsolete, and has been for a long time. At BestreferralDriver, we are a small business owners community and we like to share with our readers tips and tactics to make more money and help achieve their goals.

When you need to access capital to secure your business financing, business loans are not the only solution.

We’ve been looking for a simple, transactional solution to provide small businesses with capital. Banks are finally getting the message and are rapidly innovating their technology and infrastructure to better serve customers and SMBs.

In this article you will learn everything you have to know about Nearside, a new player focusing on innovative financial solutions for small businesses and one of the highest cash back debit card.

Nearside, formerly known as Hatch, is not a bank but a financial services and technology company headquartered in San Francisco.

In 2021 Nearside raised $58 Million Series B and it is now a leading company in the freelancer neobank space competing with other banking services such as Mercury Bank, Novo, Lili, And Oxygen, among others.

Nearside offers banking services to assist business owners and self-employed sole proprietors in managing their finances with an innovative bank account.

Additionally, the company offers lines of credit to small business owners who may not be able to get credit.

Their mobile business banking platform allows you to open a free business checking account offering great perks, and manage your finances online.

Nearside is completely digital, users can access the service through the Nearside website or use the mobile app, which is available for iOS and Android devices.

The app is really user friendly and easy to use.

There are no physical branches or offices, and deposit account services are provided by LendingClub Bank, Nearside’s partner bank.

Each Nearside account is insured by the FDIC (Federal Deposit Insurance Corp.) through LendingClub Bank, which is a Member of the FDIC.

We know how hard it can be to get a business loan when you are a small business. Common problems that could be keeping you from getting a small business loan include:

Though Nearside doesn’t offer business loans, their business checking account and debit card can be a great opportunity to save money by accessing a completely free, user-friendly solution that offers great perks and will help you save big money thanks to unlimited cashback rewards and partner discounts.

👀 Related Article: Amazon Flex Debit Card

Before you open a checking account, for personal or business use, there are some important factors you should consider:

Nearside offers a no-fee checking account that never charges monthly service fees.

Additionally, while many checking accounts require you to maintain a certain balance in order to avoid fees (which means that if you don’t meet the balance requirements, you’ll incur a monthly maintenance fee), at Nearside there is no minimum balance requirement.

Finally, it gives you access to thousands of free ATMs that you can easily find directly through the app.

👀 Related Article: Tomo Credit Card

Summarizing: let’s list below all the pros and cons of the Nearside checking account.

Do you know that Kikoff can help you build a strong credit score? Learn more about the Kikoff credit builder.

You can apply for a business checking account online, according to the fintech company the application process will only take about 5 to 10 minutes.

The agreement outlines the access to the Nearside service. If you are 18 years old or older, you can apply for Nerside business checking online by submitting your application through their website.

Follow our step by step tutorial:

💡 PRO TIP: If you are opening an account on behalf of a business entity, documents relating to the business and your EIN number may also be required

After you’ve been approved you will receive your Mastercard debit card at the address you entered when creating your account.

Once you receive the card, log in to online banking using the username and password you created during the application process and activate the card.

There are a lot of good reasons to open a business checking account with Nearside. However, the most important reason is all the perks and benefits you will get.

You will earn valuable money rewards by using your debit card for online and in-store expenses. Here is the detail of all the SMB rewards:

A number of new apps like Fetch Rewards allow users to earn cash back on their purchases and redeem rewards. The Gas Buddy gas card allows you ro save 25 cents per gallon, the Safeway just for U allows customers to get gas rewards. However, Nearside can help you save money fast by automating your savings in everyday purchases.

Indeed, Nearside offers 2.2% unlimited cash back rewards on all everyday purchases.

In our blog we often offer advice to our readers on how to save gas money using cash back apps like GetUpside.

If you are a Doordash or Uber Eats driver, looking for ways to make more money cutting your expenses, Nearside is even better than GetUpside because you will get the cash back rate of 2.2% at all gas stations, without any restrictions.

The only purchases not eligible for cashback are:

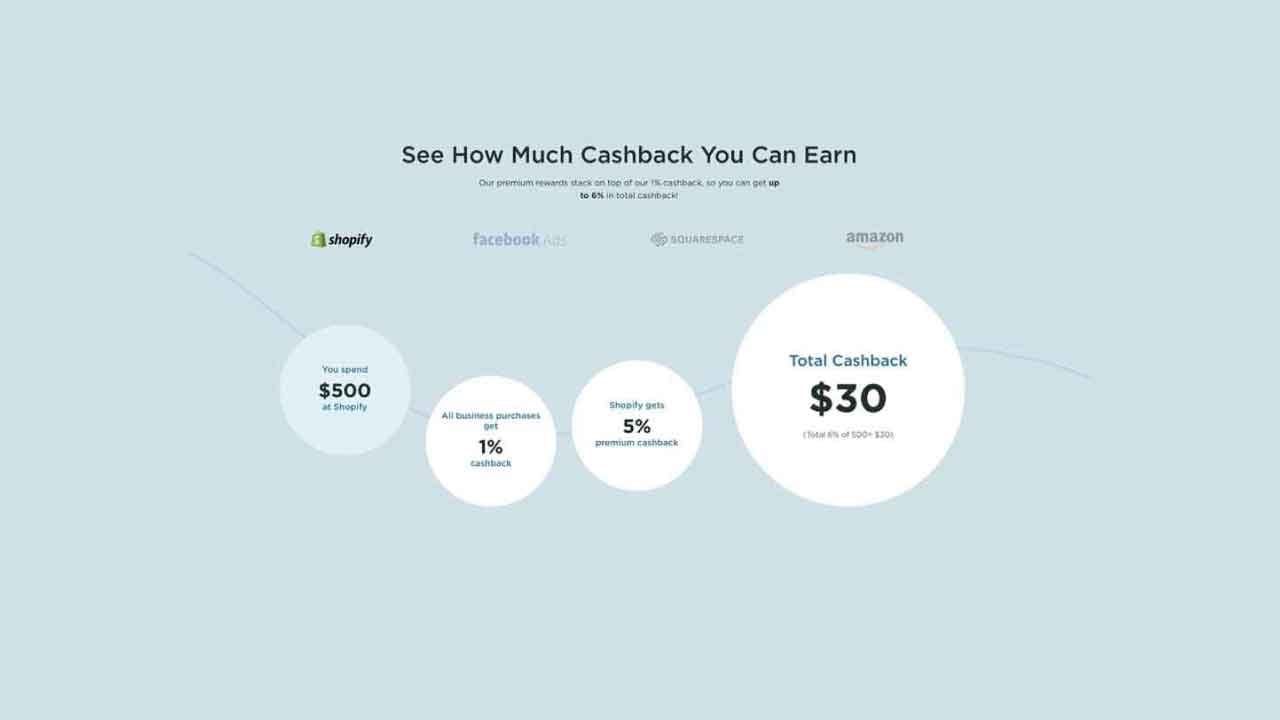

In addition to the Hatch rewards above, you can get even more cashback offers with Nearside.

Now you’ll get up to 6% cashback when you pay with that card to vendor partners including:

In addition, to help you manage your business, Nearside gives you access to tremendous perks and discounts on business softwares, products and services through your business bank account.

Banking is a competitive business. Some banks will pay you a banking sign up bonus to open a new checking or savings account.

Is Nearside offering a business checking bonus?

Near side is looking for customers and currently is offering a 20% side bonus up to $40 on first deposit to account within a week of opening.

Nearside Checking is a fantastic option for small businesses that are on the go. With its fully digital process, unlimited refunds for ATM charges, no monthly fees and an online banking app with a debit card system, it has become a great alternative to traditional business checking accounts.

The app is user-friendly and allows you to manage your business expenses in no time without any hassle. You can also download your transactions as a CSV file and upload them to your accounting software, which is incredibly helpful when trying to keep an accurate track of all expenses. The Nearside debit card also helps you optimize cash flow and earn rewards with every purchase made.

Perhaps the best thing about Nearside Checking is that it is free of charge. There are no monthly fees or hidden costs associated with using their services, making it more attractive than most other checking accounts available on the market today. Additionally, Nearside offers some extra perks such as unlimited refunds for ATM charges when using one of their 55,000 partner ATMs. This means that if you ever need cash when you’re out and about, there will be plenty of places where you can get it without having to worry about paying extra for each transaction.

On the downside, since Nearside has a fully digital focus, it cannot accommodate cash deposits which traditional checking accounts can do. This may be an issue for some businesses who require this kind of service in order to manage their finances properly. However, this drawback may not be too big of an issue if most of your transactions are done through electronic payments instead of cash deposits anyway.

All in all, Nearside Checking provides an excellent way for small businesses to manage their finances while on the go or from home thanks to its easy-to-use features and low cost structure compared to other checking accounts currently available on the market today. With its convenient online banking app and debit card system plus unlimited refunds for ATM charges when using one of its 55,000 partner ATMs makes this service stand out from the crowd even further as one of the best options available for those looking to open a business checking account without breaking the bank doing so.

No, Nearside is not a bank. It is a mobile banking platform that works in partnership with an actual bank. This platform provides consumers with the ability to perform most of their banking activities from the convenience of their mobile phones. Through Nearside, customers can open deposit accounts, manage their finances, keep track of spending, and transfer money with ease.

All of these services are provided by LendingClub Bank which is a partner of Nearside. This allows users to have access to multiple banks at once while having all their financial information consolidated in one place, allowing them to make smarter decisions with their money. With Nearside’s secure technology, customers can rest assured that their data and finances remain safe and secure no matter what device they use it on. The goal of Nearside is to provide users with an easier way to manage their money and simplify the entire banking process for them.

Nearside is a legitimate and safe company, fully FDIC insured. This means that all the deposits made at Nearside are protected up to $250,000 by the Federal Deposit Insurance Corporation (FDIC). The FDIC provides federal insurance of up to $250,000 per depositor, per ownership category, in the event of a bank failure.

In order to provide extra peace of mind for their customers, Nearside also employs advanced security measures such as encryption technology and multiple authentication processes to ensure only authorized personnel can access accounts or confidential information. All these measures make Nearside one of the safest online banking services available. Furthermore, they have an easy-to-use mobile app which allows you to manage your finances on the go with ease and convenience. With Nearside, you can easily create budget plans, save for major purchases and move money between accounts quickly and securely anytime from anywhere.

No. You can use your Social Security number to open a business account.

Whether you are a small business owner, a freelancer, an Uber driver or an app user looking for ways to save money while shopping at the grocery stores, do not get discouraged, you are not alone. The Nearside online small business checking account can clearly help you save money and focus on growing your business.

There are no lengthy forms, no long approval process. Simply apply today to request your card.

TRENDING