Kikoff Review: What Is It, How Does It Work, Is It Legit?

Bestreferraldriver is supported by its audience. We write our articles independently but we may earn affiliate commissions when you use links on this page.

If you're reading this, chances are you're looking for a way to improve your credit score. And you're not alone - bad credit is a problem that millions of Americans struggle with every day.

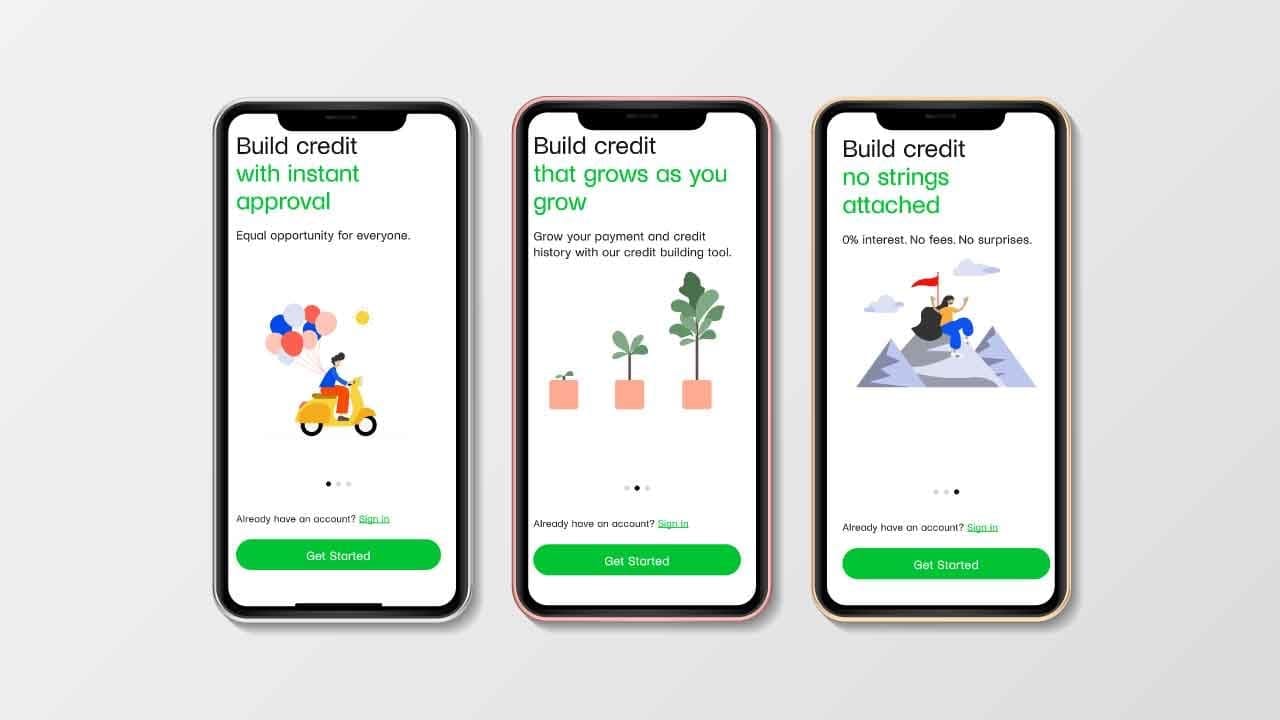

The good news is, there are solutions out there - one of which is Kikoff. In this blog post, we'll take an in-depth look at what the Kikoff Credit Builder Loan is and how it works. We'll also go over some of its main features so you can decide if it's the right solution for you.

Kikoff is a personal financial tool that helps people build their credit history. It does this by giving users the opportunity to make small payments over time, which are reported to the credit bureaus.

The credit builder loan is a loan designed specifically for people with bad credit or no credit. It's a way to build up your credit score by making on-time payments over the course of 12 months.

The main feature of the Kikoff account is that it allows users to access lines of credit and make purchases without a traditional credit card. This can be done through the Kikoff mobile app.

Additionally, the Kikoff account offers flexible repayment options, allowing users to choose their own payment due dates and amounts. They also have access to 24/7 customer support.

One unique aspect of the Kikoff credit account is its incorporation of artificial intelligence (AI) technology. This technology helps in risk assessment and fraud detection, as well as personalized financial recommendations and insights.

Overall, the kikoff line of credit provides an alternative to secured credit card or traditional credit cards with its convenience, flexibility, and incorporation of modern technology.

Other notable features include no hidden fees or interest and prepayment penalties.

To use Kikoff, you first sign up for a free account. To improve credit, Kikoff offers a credit account and a credit builder loan.

Once you create your account you will get a revolving line of credit offered by Kikoff, which currently offers a limit of $750.

At this point it is really important to understand where you can use kikoff credit?

The credit can only be used to make purchases on their online store, which features e-books on personal finance, wellness, and other subjects.

Payments can be spread out over time with as low as $2 per month. However, it's important to note that the credit limit cannot be accessed through methods such as checks.

Each month, Kikoff reports your payment history to the major credit bureaus, such as Equifax and Experian, helping to build your credit score.

This is an add-on that consumers may choose to purchase if they wish to accumulate even more credit. The cost of participation is $10 per month throughout the course of the year. This product will be available following your first payment with the credit builder loan company.

The Kikoff Credit Builder Loan works by giving you a loan with fixed monthly payments. You'll make these payments over the course of 12 months, and as long as you make them on time, your credit score will gradually improve.

In both cases, using Kikoff helps build your credit by showing consistent and on-time payments to the credit bureaus. Additionally, having a mix of both a credit account and a loan can also positively impact your credit mix factor in determining your overall score.

👀 Related Article: Revolut Review

Payment history, credit utilization, account age, and credit mix are all factored into an individual's credit score.

A credit app like Kikoff helps build credit in four main ways:

The largest single component in your score is your payment history (35%). The report analyzes your payment history for previously opened credit accounts. Your monthly payments on your Kikoff Credit Account and Credit Builder Loan will be included in your credit report.

Credit utilization is the percentage of your available credit that you are currently using. For example, if you have a credit card with a limit of $1,000 and you have a balance of $300, your credit utilization would be 30%.

It is important to keep your credit utilization low because it can have a big impact on your credit score. A high credit utilization ratio can signal to lenders that you are relying too heavily on credit and may not be able to handle more debt. On the other hand, a low credit utilization ratio shows that you are managing your credit responsibly and may be a lower risk for lenders.

One way to keep your credit utilization low is by only using a small portion of your available credit at any given time. This could mean paying off your balances each month or spreading out purchases over multiple cards instead of maxing out one card.

You can also try to increase your available credit by requesting a higher limit on your existing cards or opening new lines of credit. Just make sure not to open too many new accounts in a short period of time as this can negatively impact your credit score.

Overall, maintaining a low credit utilization ratio is an important aspect of managing and improving your overall credit health.

The account age is the average length of time that all of your credit accounts have been open. A longer account age can indicate responsible financial behavior and may positively impact your credit score.

Having a high account age can also give lenders confidence in your ability to manage credit over a long period of time.

On the other hand, opening and closing multiple accounts in a short period of time can be seen as red flag by lenders and may negatively affect your credit score.

It is important to note that closing an older account can actually lower your account age, so it may be beneficial to keep older accounts open even if you are not actively using them.

Overall, maintaining a high account age can benefit your credit standing and ensure that lenders see you as a responsible borrower.

The credit mix refers to the variety of different types of credit accounts a person has. This can include things like credit cards, car loans, student loans, and installment loans.

Having a diverse credit mix can be beneficial for a person's credit score because it shows that they are able to manage multiple types of credit responsibly. It also demonstrates their ability to handle different payment schedules and varying amounts of debt.

However, it is important to note that having too many open lines of credit can be risky and can potentially harm a person's credit score if they are unable to manage them effectively. It is also important to make sure that payments are made on time for all accounts in order to maintain a healthy credit mix.

Overall, having a diverse credit mix can be advantageous for a person's financial standing, but it should always be managed responsibly and carefully.

👀 Related Article: How To Contact Kikoff Customer Service

After researching and reading various customer reviews, it is clear that Kikoff is not a scam.

First of all, the company was founded in 2019 by Christophe Chong, Cynthia Chen, who saw an opportunity to help people have a good credit score to secure loans.

The company is headquartered in San Francisco, CA and has numerous investors including Portage Ventures and Core Innovation Capital.

The personal finance platform has a strong online presence with positive customer reviews on reputable websites such as Trustpilot and BBB.

The company also offers a mobile app that allows users to track their credit score and apply for new credit products.

The Kikoff credit app, available on the App Store for iOS and on the Google Play Store for Android devices, has been receiving positive feedback from users. However, some reviewers have expressed confusion about the service offered.

With an average rating of 4.8 out of 5 stars on both app stores, the majority of users are satisfied with Kikoff's ability to help them improve their credit score.

But some reviewers were not aware that Kikoff is not a traditional credit card or loan provider. Instead, it helps users build their credit by reporting regular payments to credit bureaus and offering personalized tips and guidance.

In conclusion, based on all of the evidence above, it can be confidently stated that Kikoff is a legitimate company offering valuable financial services.

Overall, Kikoff is a great financial tool for people who are looking to improve their credit scores. It has several features that make it user-friendly and accessible for everyone. However, there are also some drawbacks that should be considered before signing up for the app. Let's take a look at the pros and cons of using Kikoff.

When making a purchase, whether it is a big-ticket item or something as small as a new book, it is always helpful to consult reviews from other customers. These reviews can give you critical insights into the product, such as its quality, durability, and usability.

In some cases, reviews can also alert you to potential issues that you may not have considered. Find below some Kikoff credit reviews.

1) "I was skeptical about using the Kikoff app to build my credit, but it really did work! I started on a low score and saw steady improvement each month. The app is also super user-friendly and makes it easy to keep track of payments and credit activity."

2) "I highly recommend Kikoff for anyone looking to improve their credit score. I used the app for several months and saw a significant increase in my score. It's a great tool for staying on top of payments and monitoring progress."

3) "Kikoff has been a lifesaver in helping me build my credit. The app is easy to use and has really helped me stay on top of payments and improve my score. Would definitely recommend it to others looking to improve their credit."

👀 Related Article: Kikoff vs Self

Kikoff does not do a credit check, but a customer must be able to verify their identity.

In order to use the credit building service you must have the following requirements:

No, Kikoff’s main product is a credit account and the purpose of the account is to help build credit rather than as a traditional credit line

Customers can use their $750 line of credit at the online Kikoff store, where they'll find a wide selection of educational materials and tools such as budgeting apps, books on personal finance, and even credit score monitoring. Rather than paying for each product individually, customers can join the $5/month membership program and use their line of credit to access the items they need. This makes it easier to build your financial literacy skills and establish strong money habits with little up-front cost.

The Kikoff Credit Builder Loan is a great solution for people with bad credit or no credit who are looking to improve their credit score. It's easy to use, with fixed monthly payments and direct deposit into your bank account. Best of all, it reports to all three major credit bureaus, so you can be sure that your on-time payments will help improve your score over time.

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

How to Lock an Electric Scooter and 5 Best Locks

E-Scooter Locks