Doordash 1099: How to Get Your Tax Form and When It's Sent

Doordash has been growing fast during the last two years and not only in terms of sales and customers but also for the number of self employers that make money delivering alcohol , food, groceries and more with Doordash.

Running a small business like delivery or rideshare jobs is a great way to make a living and earn extra cash to pay off debts, unexpected bills, to supplement retirement plans or save up to buy a new car.

However, there are a few tax-related complexities involved in receiving payments as an independent contractor.

When it comes to taxes, independent contractors receive 1099 forms from the company they work with. U.S. taxpayers need to get acquainted with form 1099 and reporting earnings.

Whether you are unfamiliar with the 1099 tax form, or you have questions concerning the DoorDash tax form, we tried to make it easier for you. Below you’ll find some of the most important questions and answers related to DoorDash 1099.

The 1099 form is a document that the Internal Revenue Service (IRS) refers to as an “income reporting form ”. Basically the form reports non-employment income earned through a tax year.

As a reminder a tax year is also considered a calendar year.

The form will be an easy support when filing your taxes. As a reminder, DoorDash Drivers have to pay two kinds of taxes: income taxes and self-employment tax.

When you earn money, you'll have to pay income taxes. Income taxes are calculated by taking your gross earnings and deducting any money spent for working related expenses.

We suggest you take a look at our step by step guide to DoorDash taxes. You will learn more about Standard Mileage deduction, Actual expenses deduction.

Typically, try to set aside 30% of your earnings each year to pay income taxes.

Delivery drivers are not employees of Doordash, so they pay their own Social Security and Medicare taxes. To calculate your self-employment taxes, you will need to calculate your net income by taking your gross income minus any work-related expenses. You will need to pay a 15.3% self-employment tax on your net income if your net income is above $137,700.

You also need to pay the 2.9% Medicare part of the SE tax on all your net earnings.

If you expect to owe tax of $1,000 or more when your return is filed you will have to make estimated tax payments using the form 1040.

To avoid penalties you should calculate the appropriate amount to pay and make quarterly tax payments that are generally due four times per year: April 15, June 15, September 15, and January 15.

Whether you are a US citizen or not, if you earned at least $600 in one year delivering with Doordash or with other activities, including referring other drivers, you will receive a 1099 tax form.

At BestReferraldriver we provide support to all business owners, including DoorDash merchants.

DoorDash will issue 1099s only to merchant partners who earned more than $20,000 in sales and did 200 transactions / deliveries or more during the previous year.

💡 PRO TIP: Please note that even if you didn’t earn enough to get a 1099 form you have to report your earnings to the IRS

There are nearly 12 different versions of 1099 forms depending on the different types of income, other than salary and your activities on the platform. You cannot choose which kind of form you will receive. The IRS sets rules and reporting requirements that Doordash follows.

We do not want to cause you a headache describing all the types of form you can find out there.

DoorDash issues only two types of 1099 forms:

According to the IRS, starting from 2020, businesses are required to report some types of non-employee compensation on form 1099–NEC. Previously, the form 1099-MISC was used to report this kind of non-employee compensation.

If you’re a Merchant, you’ll have to pay taxes on your income and you need this form to file your taxes.

According to the IRS, you should receive a 1099-K if you have a business and have at least 200 transactions and at least $20,000 in sales during the year that are processed by third-party payment processors.

As we said, DoorDash will issue a 1099-K to merchant partners in the United States to summarize their sales activity.

The form is issued in two copies, one for the partner, the other for the IRS.

Deductions are one of the most important benefits for 1099 self employed. So, what can you write off as a 1099?

The IRS offers self-employed exemptions allowing them to write off expenses and mileage. The deductions can help you minimize your tax liability. By using the Schedule C you can deduct business expenses and mileage for your taxes.

Keep in mind that, as a 1099 you can get reimbursed for your business mileage. However, you cannot get reimbursed for driving to work.

You should always choose hotspots near you. Other 1099 tax write offs include:

There are two different ways you can get your form on the Doordash platform:

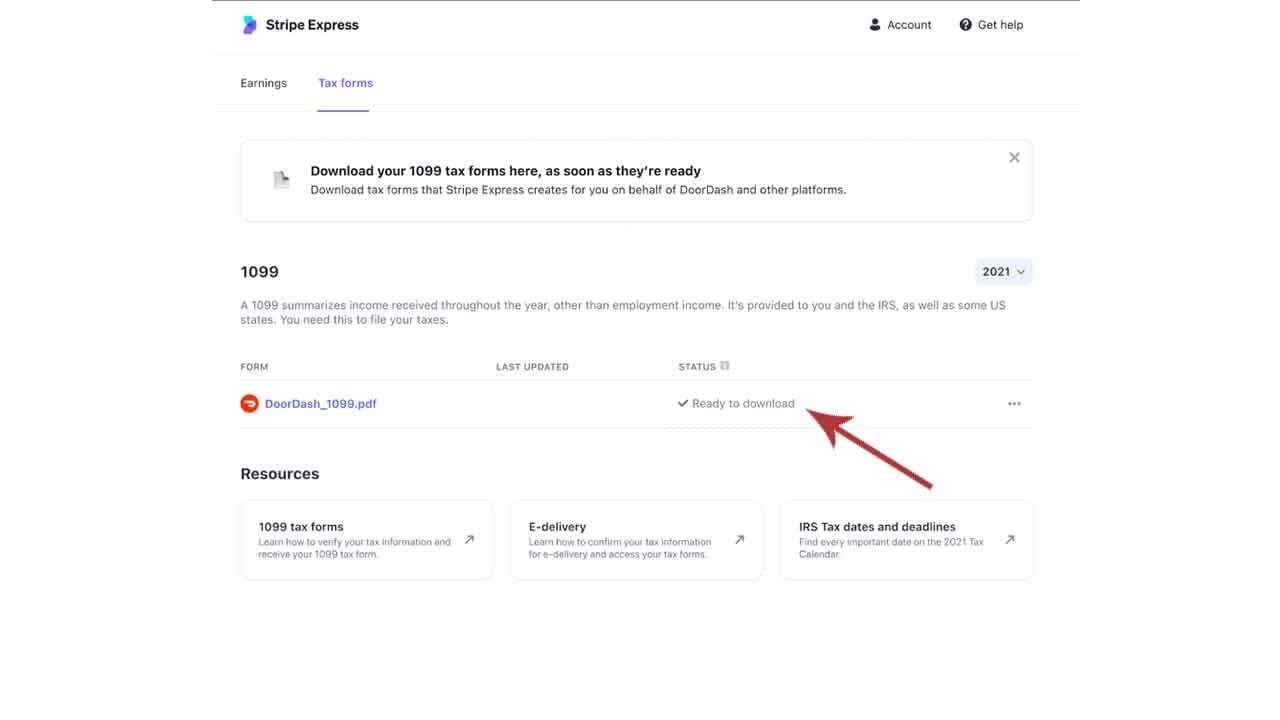

Stripe is an American financial services and software as a service (SaaS) company headquartered in San Francisco. Stripe and DoorDash have made a partnership. Currently Stripe files all the 1099 tax forms for the online delivery company.

Stripe also reports to the IRS. Indeed, the IRS requires that Stripe provide a form called a 1099-K for each Stripe account that meets some criteria.

However you should give them an authorization to deliver the tax form online.

Connecting your DoorDash account with Stripe Express is an easy way to manage and download tax forms, track payments in real time, see upcoming payouts and keep your information up to date.

Via the Stripe Express account, you’ll be able to review important tax information including:

In November 2021 you should have received an email from Stripe. If you didn't received you can do the following:

Once you created your Stripe Express account, If you want to download your 1099 form online, please follow our step by step tutorial:

If you didn’t receive an email from Stripe or didn't consent to e-delivery, Stripe will send you by mail a copy of your 1099 tax form. Keep in mind that the mail delivery via UPS standard service can take up to 10 business days.

The deadline to distribute 1099s is january 31. If you didn’t get the form that reports payments for the services provided on the platform a few days after that deadline, you can contact DoorDash.

If you still do not get the form by February 15, call the IRS for help at 1-800-829-1040.

So, you’re waiting for 1099 but you didn't get 1099 from your employer.

This is an important point for you to understand. You are not required to submit this form to the IRS and/or state tax agency when e-filing a tax return. However you are required to file and pay for your taxes even if you didn’t receive your form.

DoorDash is required to send a copy to the IRS as well as to you .

This means that the IRS has this income information for you even if you failed to receive your copy. Using your Social Security number, the IRS automatically checks the amounts on the information returns the agency received against the income reported on your return.

The fact you didn’t receive your 1099-nec form or you lost your 1099 form will not have any impact on your tax return as long as you report the income you earned.

If you are a self-employed person, the best advice we can share with you is to always keep track of any kind of income earned throughout the tax year.

You can easily do this using your bank app or your bank account statements. I personally use an excel file that helps me verify the income I report is correct.

If you really do not feel comfortable doing that, you can get help from a tax professional.

Errors happen, this is why you should always be able to track your earnings and check the information on your 1099-NEC is correct and match to the information that you yourself have.

If you notice errors on a 1099-NEC, contact DoorDash and ask them to correct it.

If you have a Stripe Express account you can easily correct any errors and get a new 1099 form within 24 hours.

You may notice that your 1099-NEC shows a lower amount than the earnings you see on your Stripe Express account. That's because the earnings you get direct deposited into your DasherDirect account are not shown on Stripe Express. You can see those by checking Payfare, using your DasherDirect By Payfare account. The 1099 will include your DasherDirect earnings, though.

If you have been working with DoorDash since longtime, you are probably used to getting your form via the Payable platform. However Payable and DoorDash are not anymore partners. The payment platform is shutting down.

Door dash 1099 form must be sent to recipients by Feb. 1 and filed with the IRS by March 1.

If you do not feel comfortable filing taxes by yourself, you can use Turbotax. Turbotax is currently one of the best tax software you can find.

Keep in mind that to claim your self-employment income you need at least the TurboTax Deluxe version that currently cost: $40.

Follow this step by step tutorial to enter your Doordash income on Schedule C.

If you sign up for a DoorDash driver job you are usually an independent worker and not an employee. There is no DoorDash salary and your earnings are related to the number of deliveries you perform on the platform.

Being a successful Doordash depends on your ability to provide delivery faster and know the best times to Doordash in your area.

We suggest you read our guide on how to make more working with DoorDash.

However, the San Francisco headquartered company started to hire couriers. Take a look at our guide to employee delivery.

Yes, you have to pay taxes on the income reported on a 1099. However you can lower your taxable income with the write offs. Do not forget to track your mileage.

Doordash is not an LLC but an INC. As a corporation they have to meet many more guidelines, electing a board of directors, adopting bylaws, having annual meetings, and creating formal financial statements.

Taxes are not funny, however, now you know everything you have to know about the 1099 including the purpose, who should receive it and what to do if you didn’t get a copy from DoorDash.

If you are a Dasher, you will receive a 1099-NEC that you should use to report your non-employment DoorDash income. If you are a merchant on the platform, Doordash will issue a 1099-K.

Whether you receive your 1099 form or not, you have to pay taxes on your income and are required to report your earnings when filing your taxes.

This material has been prepared for informational purposes only, Doordash and BestReferralDriver do not provide tax advice.

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Doordash promo code, Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

Can you Split Fare on Lyft? How to do it

Split Lyft

Become a Dasher! Sign up and deliver with Doordash

DoorDash Promo