Myfico Review (2024): Is This Credit Score Service Worth It?

If you're looking for a comprehensive Myfico review, you've come to the right place. In this article, we'll take a look at all of the features My Fico offers and determine whether or not it's worth your money. We'll also discuss how accurate myfico is and whether or not it's free to use. Keep reading to get all of the information you need before deciding if Myfico is the right credit score service for you!

Myfico.com is a website owned by FICO, which is a company that develops credit scoring algorithms. It is a consumer division of Fair Isaac. The company was founded in the early 1960s by engineers Bill Fair and Earl Isaac. At the time, the two were working on a project for the credit industry, and they realized that there was a need for a more accurate way to measure credit risk.

This led to the development of the FICO score, which is now used by lenders all over the world to assess a borrower's creditworthiness.

MyFICO offers a range of products and services including credit scores and credit reports to consumers. Since 2001 over 23 million scores have been sold through its website.The website also helps consumers understand their credit health and take action to improve it through educational resources such as articles and videos, as well as a variety of tools and calculators.

The website Myfico.com allows consumers to check their credit score and credit report for free, and also offers paid products that provide more in-depth information about a person's credit history.

MyFico offers three main services: credit reports, credit scores, and identity theft protection.

A credit report is a detailed history of how you have used credit in the past. It includes information such as how much credit you have used, how often you have applied for new credit, and whether you have missed any payments. A credit report can be used to assess your creditworthiness and determine your interest rate for a loan.

Your credit score is a number that summarizes your credit history into a single number. Your credit score is used to determine your eligibility for loans and other financial products. A high credit score means that you are a low-risk borrower, which could result in a lower interest rate on a loan. A low credit score means that you are a high-risk borrower, which could result in a higher interest rate or denied loan application.

Identity theft protection is a service that helps protect your personal information from being stolen or used fraudulently.

One of the most worrying pieces of data that could be leaked is the social security numbers. In the wrong hands, this information can be used to commit identity theft on a massive scale. And indeed, it is estimated that over a million people have been victims of identity theft as a result of data breach.

It is important to take steps to protect your identity. This may include changing your passwords, monitoring your credit report for suspicious activity, and being alert for any phishing attempts. By taking these precautions, you can help to safeguard your personal information in the wake of data breach.

MyFico offers two types of identity theft protection: identity monitoring and identity theft insurance.

Identity monitoring is the service that monitors your personal information for signs of identity theft. If MyFico detects any suspicious activity, they will alert you and help you take steps to protect yourself from identity theft.

Identity theft insurance is a policy that provides financial reimbursement if you are the victim of identity theft. MyFico's identity theft insurance policy covers up to $1 million in damages, making it one of the most comprehensive policies available.

It is difficult to say whether or not a myFICO score is accurate, as this largely depends on the individual's credit history and credit score calculation. However, myFICO does claim to use "the most sophisticated scoring model available," which may lead to a more accurate representation of an individual's credit risk.

That said, it is important to note that myFICO does not actually generate credit scores; rather, it sells access to credit score information from the three major credit reporting bureaus - TransUnion, Experian, and Equifax. Therefore, there may be some variance in an individual's myFICO score depending on which bureau's information is used.

Overall, while myFICO claims to provide an accurate representation of an individual's credit risk, it is ultimately up to the individual to confirm this accuracy. There are a number of ways to check one's credit score for free, and it is recommended that individuals review their credit report at least once a year. Doing so can help identify any errors or discrepancies in one's credit history that may have led to an inaccurate credit score calculation.

MyFico is a legitimate and reliable credit scoring company. It has been accredited with the Better Business Bureau (BBB) since 2010 and has held an A+ rating ever since. MyFico provides credit scores, credit reports, and credit monitoring services to individuals and businesses in the United States.

However, the company has received some criticism over the years for its high prices and for allegedly misleading customers about its products. However, overall, MyFico is considered to be a reputable and reliable source of information about credit scores and credit reports.

When it comes to credit scores, you may be wondering which one is the best: MyFICO or Experian? Both of these services are popular options for consumers, but which one should you use to get an accurate picture of your credit score?

MyFICO is a well-known name in the credit score industry. The company was founded in 1956 and has been helping people measure and improve their credit scores ever since. MyFICO offers a variety of services, including access to your credit score, credit monitoring, and identity theft protection.

Experian is also a popular choice for consumers when it comes to credit scores. The company was founded in 1966 and offers a variety of services, including access to your credit score, credit monitoring, and identity theft protection.

So, which service is better? It really depends on what you’re looking for. MyFICO may be a better choice if you’re looking for a simpler interface, but Experian offers more features and services than Fico does. Experian can also help you build your credit with their free service Experian Boost .

Overall, both MyFICO and Experian are good choices when it comes to getting an accurate picture of your credit score. If you want more features and services, go with Experian. If you want a simpler interface, go with MyFico.

Myfico is a monthly membership subscription which auto renews and unfortunately there is not a free trial. However, if you decide that you no longer want to use the service, you can easily cancel your subscription.

When it comes to canceling your FICO membership, there are a few ways to do it. You can cancel through the Subscription menu on the Myfico app, you can contact Myfico customer service to cancel your account or you can use a free cancellation subscription service like Rocket Money.

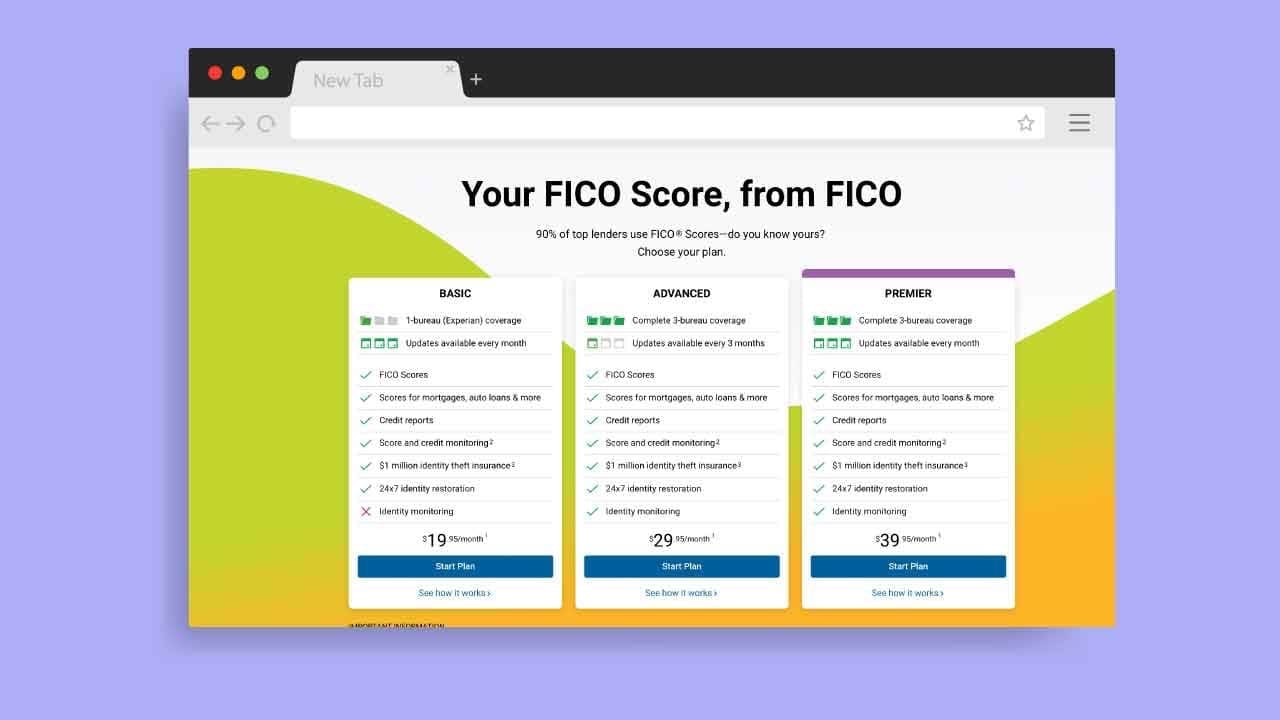

The amount you pay depends on which Myfico subscription you choose. How often myfico updates also depends on which plan you choose.

There are four plans: Free, Basic, Advanced, and Premier.

The MyFico Free Plan is a great way to get your FICO Score straight from the people that created it. Plus, you get free Equifax credit monitoring and a free Equifax credit report every month. There is no credit card required, so it's a great way to keep an eye on your credit score and your credit history.

The Standard plan is the most basic and includes your credit score and credit report summary from Experian. The Basic plan updates your credit score once every 30 days.

The Standard plan costs $19.95 per month.

The Advanced plan includes your credit score and credit report summary from the three Bureaus. The Advanced plan updates your credit score once every 3 months.

The Advanced plan costs $29.95 per month.

The Premium plan includes your credit score and credit report summary from Experian, TransUnion, and Equifax. The Premier plan updates your credit score every month.

The Premium plan costs $39.95 per month.

The first step is to create an account and agree to the terms and conditions. Once you have created an account, you will be asked to choose a plan.

Once you have chosen a plan, you will be asked to provide some personal information including your name, address, Social Security number, and date of birth. Be sure to enter this information accurately because it will be used to generate your credit reports.

After you have entered this information, you will be asked to verify your identity by providing some additional information such as your driver's license number or passport number.

Once your identity has been verified, you will be able to view your credit reports and credit score. You can also use the Myfico app to view your credit reports and credit score on the go.

There is a lot of misinformation on the internet about credit scores. Some people believe that MyFICO has a direct impact on their score. This is not true.

MyFICO is simply a tool that consumers can use to track their credit score. It is one of many sources that lenders may use to evaluate a borrower's creditworthiness.

The most important factor in determining a credit score is the borrower's credit history. Lenders will look at how long the borrower has had credit accounts, how late they have been on payments, and how much debt they have accumulated. The higher the debt-to-income ratio, the less likely a lender is to extend credit.

Other factors that lenders may consider include the borrower's age, occupation, and residence history. Borrowers with a longer credit history and a good payment record are more likely to get approved for a loan than those who have recently acquired credit or have had negative marks on their credit report.

While MyFICO cannot directly impact a credit score, it can be helpful for consumers to monitor their credit score and identify any potential problems that need to be addressed. By monitoring one's credit score, borrowers can take steps to improve their score and make themselves more attractive to potential lenders.

No, myFICO does not perform hard pulls. A soft inquiry is when a lender checks your credit history to see if you are eligible for a loan, and it doesn't affect your credit score. A hard inquiry is when you actually apply for a loan, and it can lower your credit score.

There is no simple answer to the question of whether or not myFICO is worth it. The answer depends on a variety of factors, including your overall financial situation and your credit score goals.

myFICO offers a number of different services, all of which may be worth the cost depending on your needs. The most well-known service is the FICO score, which is used by lenders to determine your creditworthiness. myFICO also offers a credit monitoring service that alerts you to changes in your credit report, as well as a credit optimization service that can help you improve your credit score.

The main benefit of using myFICO is that you have access to your FICO score. This is the most widely used credit score by lenders, so having this score can give you an advantage when applying for a car loan, if you want to buy a house or sign up for a credit card. MyFICO also offers educational resources that can help you understand your credit report and how to improve your credit score.

It is also important to understand that FICO is not a credit repair organization as defined by the federal Credit Repair Organizations Act or similar state laws including the credit repair laws.

Your credit record, credit history, or credit rating cannot be "cleaned up" or "improved" with the aid of FICO; the company does not provide services or recommendations that are often referred to as "credit repair," nor does it provide advice or assistance in these areas. If you need to build your credit score you should use credit building apps such as Self, Kikoff or Kovo.

Finally, there are a few drawbacks to using myFICO. First, the services are not cheap - the FICO score basic plan costs $19.95. Second, myFICO only provides scores; other apps will do the same and will also help you grow it! Finally, some people find that the educational resources offered by myFICO are not enough, and they need to seek additional help elsewhere.

Overall, whether or not myFICO is worth it depends on your individual needs. If you're looking for access to your FICO score and want to improve your credit score, then myFICO is definitely worth it. However, if you're looking for more comprehensive education and assistance with repairing your credit, then you may need to look elsewhere.

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

How to Lock an Electric Scooter and 5 Best Locks

E-Scooter Locks