Experian Boost Review (2024): Is it Safe and Worth it?

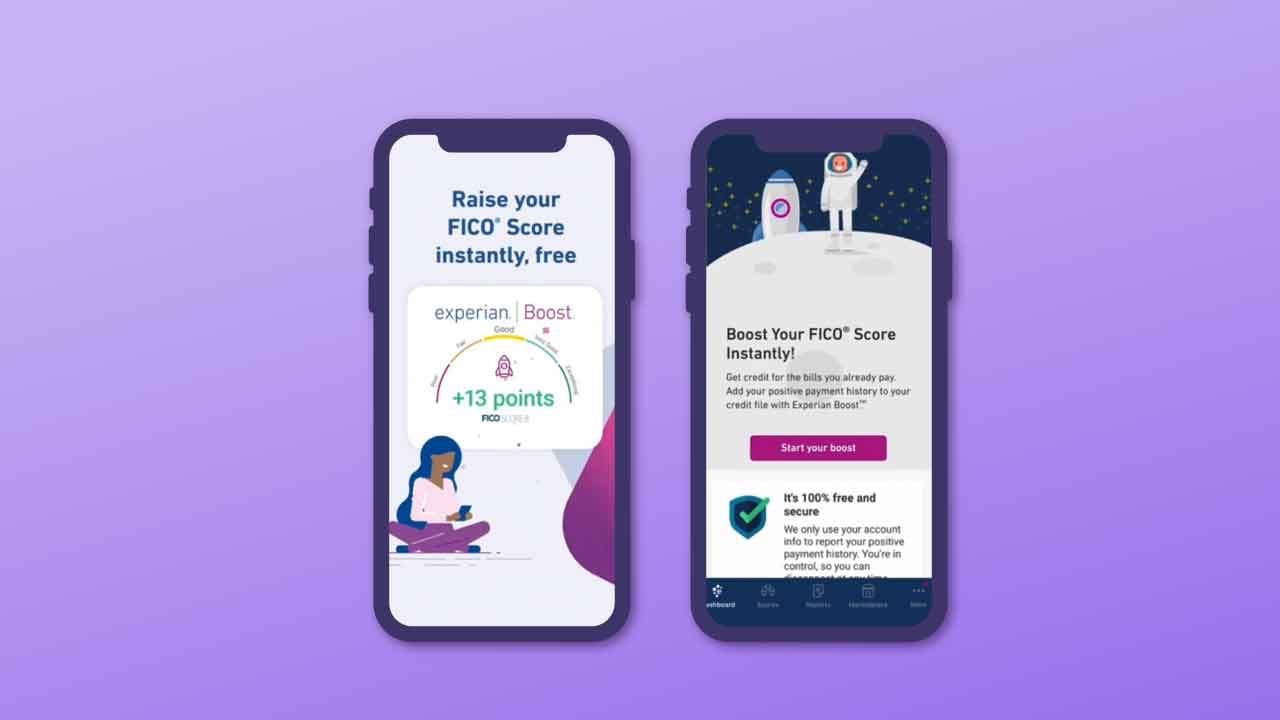

If you're looking for a way to improve your credit score, Experian Boost may be the solution for you. This new service launched in early 2019, and it has been gaining popularity ever since. In this Experian Boost review, we'll discuss how it works, is Experian boost safe, and whether or not it's worth it. We'll also provide a few tips on how to get the most out of this service!

Experian Boost is a service offered by the credit reporting agency Experian that allows consumers to add their utility and phone bill payment history to their credit reports. This can potentially increase their credit scores, including Fico and Experian credit scores, making it easier for them to obtain loans and other forms of credit.

Building credit is important for everyone, but especially for young adults who are just beginning to establish themselves financially.

Having a good credit score can help you get approved for loans and credit cards, and can also help you get a lower interest rate on those loans and credit cards. A good credit score can also help you rent an apartment, get a job, or buy a car.

According to Experian's website, typical customers who got a boost raised their Experian Data-based FICO Score by 13 points.

To use Experian credit boost, consumers first need to link their bank account to allow Experian to access their payment history. They then have the option to select which bills they want included on their credit report. Once this information is verified with the respective providers, it will be added to the consumer's Experian credit report and factored into their credit score calculation.

Some critics have raised concerns about the potential for errors in this process, as well as the fact that Experian Boost only looks at positive payment history and not any late or missed payments. However, many consumers have reported seeing an increase in their credit scores after using this service.

Overall, Experian Boost can be a helpful tool for those looking to improve their credit standing and potentially access better loan terms. It may also incentivize responsible bill payment behavior among consumers.

Now you know that Experian Boost is a new feature offered by credit reporting agency Experian that allows consumers to update their credit report with their positive payment history from utility and telecom companies. Experian Boost can retrieve positive payment data dating back up to 24 months.

Starting in October 2022, Experian will also include rent payments in credit reports.

Consumers can link their accounts from these companies to their Experian account, and the positive payment activity will be factored into their credit score. This can potentially increase a consumer's credit score, giving them access to better interest rates and loan terms.

But how does it work?

To use Experian Boost, consumers first need to create an online account with Experian. You can also download the Experian app which is available on the app store and Google play store.

You must provide some personal information, such as:

They then have the option to link their bank accounts (you can also link online bank accounts) through Experian's secure platform.

💡 PRO TIP: Experian boost won't connect to your bank. Keep in mind that not all banks are supported

Once the bank accounts are linked, pick the on-time payment history you would want to have updated on your Experian credit report.

Experian will automatically update a consumer's credit report with any positive payment activity on these accounts.

👀 Related Article: Kikoff Review

It should be noted that Experian Boost only considers positive payment history, so late or missed payments on these bills will not impact a consumer's credit score in a negative way. However, it also does not consider other factors that go into determining credit scores, such as loan or credit card payments or length of credit history.

So, what bills qualify for experian boost?

Experian Boost looks for payments for utilities such as:

It's important to note that Experian Boost only considers payments that are made on time. So, if you consistently pay your bills late or have missed payments, they will not be factored into your credit score.

Experian Boost requires at least three months of payments within a six-month window to accurately assess your bill payment history.

One thing to keep in mind is that Experian Boost only considers these specific types of bills. It does not take into account other regular expenses like rent or car payments. Therefore, it's important to continue making all of your payments on time in order to maintain a strong credit score.

In addition, it's important to remember that Experian is just one aspect of determining your credit score. Your credit report also includes information about any past loans or lines of credit, as well as any negative marks such as missed payments or bankruptcy filings.

👀 Related Article: CreditRepair.com Review

Yes, Experian Boost is safe.

First of all, it is important to note that Experian Boost only uses information from your bank and credit card accounts that you have already linked to the service. This means that no new or additional information is being collected about you.

Additionally, Experian has robust security measures in place to protect your personal information. This includes using encryption technology, regularly monitoring for threats and vulnerabilities, and adhering to industry security standards such as PCI DSS.

Furthermore, Experian Boost gives users control over their data by allowing them to easily view and manage their linked accounts at any time through their online account or Experian Boost app. Users can also choose to unlink an account or stop using the service altogether at any time.

Some people may be hesitant to link their bank account to a third party website, but Experian assures users that all of their information is secure and protected. They use 128-bit SSL encryption technology in order to protect users' personal and financial data.

Overall, Experian Boost's use of already-linked financial account information, strong security measures, and user control make it a safe option for those looking to potentially improve their credit score.

The short answer is yes, Experian Boost is legit.

First off, it’s important to note that Experian Boost is offered directly through one of the three major credit bureaus – Experian. This means that the service has undergone a significant amount of scrutiny and regulation in order to be able to operate within the industry.

Additionally, Experian Boost has also received endorsements from both government agencies and personal finance experts. The Consumer Financial Protection Bureau (CFPB) has praised Experian Boost for giving consumers more control over their credit scores, and has recommended the service as a way to quickly improve their credit.

While it’s always wise to exercise caution when it comes to sharing personal information online, there have been no reported instances of fraud or misuse of data in relation to Experian Boost.

In fact, the service uses bank-level encryption technology to protect users’ information and requires identity verification before allowing access to your credit profile.

Overall, using Experian Boost can be a legitimate and effective way for consumers to quickly boost their credit scores by having certain monthly bills like utilities and phone bills factored into their credit history.

👀 Related Article: Kovo Credit Review

Let’s take a look at some pros and cons of Experian Boost.

One potential benefit of Experian Boost is that it gives consumers with limited or no traditional lines of credit the opportunity to improve their credit score. For example, someone who pays for utilities in cash each month may not have any regular lines of credit reported on their credit report, but using Experian Boost they can now show consistent positive payment activity on their utility bills.

We collected for you the main benefits of the service:

Finally, it is important for consumers to keep in mind that while this feature may increase their overall credit score, it may not necessarily result in immediate access to better loan terms or interest rates. Lenders also consider other factors such as income and employment history when determining loan offers, so it is important for consumers to continue managing their finances responsibly in order to see the full benefits of an improved credit score.

👀 Related Article: MyFico Review

It is critical to read some user reviews before signing up for any service. Below are some positive and negative reviews of the Experian service.

Positive Review 1: "I have been using Experian Boost for a few months now and have already seen an increase in my credit score. It's so easy to use and link my utility and cell phone payments to boost my score even more. I highly recommend it!"

Positive Review 2: "Experian Boost has been a game changer for me. I never knew that adding my utility payments could have such a positive impact on my credit score. Thank you for this valuable service!"

Complaint 1: "Experian Boost did not work for me. I linked all of my bills and payments but saw no change in my credit score."

Complaint 2: "After using Experian Boost, my credit score actually went down. I wish I had never signed up for this service."

Yes, Experian Boost is free to use. There are no hidden fees or charges for using the credit score booster. In fact, Experian states on their website that they will never ask for your credit card information.

Furthermore, Experian Boost does not require a credit card or subscription in order to use it. You can simply log into your Experian account and activate the Boost feature for free.

No, Experian Boost cannot hurt your credit. While it is possible for a decrease in your FICO® Score to occur as a result of linking your bank accounts, this decrease is temporary and can easily be rectified by disconnecting the accounts. Additionally, even if your score stays the same after using Experian Boost, keeping the accounts linked can still benefit your overall credit health in the long run.

It's important to remember that Experian Boost works by identifying positive payment history that may not have been previously reported to the credit bureaus. This means that by using Experian Boost, you could potentially see an increase in your credit score as these positive payments are added to your report.

Overall, Experian Boost provides a convenient and easy way for consumers to potentially improve their credit scores by taking advantage of on-time payments being made from their linked bank accounts. As long as you continue making those payments on time, Experian Boost can only help strengthen your credit standing.

In my opinion, Experian Boost can definitely be worth it for some individuals. The service can potentially improve your credit score by taking into account consistent on-time payment for utilities, cell phone plans, and streaming video services. However, it's just one aspect of maintaining a strong credit history and it's important to continue making all of your payments on time and managing any existing loans or lines of credit responsibly. We suggest you consult our guide with the best credit building apps .

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.