Self Credit Builder Review: What Is it and How Does It Work?

If you're looking for a way to build your credit, you may have come across Self. But what is it, and how does it work? In this Self app review, we'll take a look at what a Self Credit Builder Account 1 is and how it works. We'll also discuss the pros and cons of using Self so that you can decide if it's the right choice for you.

We'll also provide some tips on how to better your credit in general. So whether you're considering using a Self Credit Builder Account or just want to know more about credit, keep reading our Self review!

The Self Credit Builder Account 1 is a plan that helps individuals build their credit by providing them with tools and resources to manage their credit responsibly. This includes setting up one of the four personalized payment plans, monitoring credit activity, and providing educational materials on how to build and maintain good credit.

Building good credit is important for numerous reasons. It can determine whether or not you are approved for loans, including a mortgage, as well as the interest rates you may receive. Good credit can also impact your ability to rent an apartment or even get a job.

While there are various ways to build one's credit, Self may provide structure and guidance in this process.

In this article we focus on the Self Credit Builder Account, a tool offered by Self Financial that allows users to build their credit by taking out a loan and having the funds secured in a Certificate of Deposit (CD). The user then makes regular payments on the loan, which can build their credit. It is important to make sure that the loan payments can be consistently made on time, as late or missed payments can negatively impact credit.

It's important to note that Self does not guarantee an immediate bump in one's credit score. Building one's credit takes time and effort, and it is ultimately up to the individual to make responsible financial decisions in order to see improvement. However, the Self Credit Builder Account could serve as helpful resources in this journey towards better credit.

Now you know that Self can help build credit, but how does it actually work?

The Self Credit Builder Account 1 works by allowing individuals to build savings while simultaneously building their credit history. The Self app is available to download on the App Store for Apple users and on the Google Play Store for Android users.2

Here’s a more comprehensive review of how the account works.

First, the individual picks a plan that fits their budget and then applies for a Credit Builder Account1, through Self. Once approved, the funds are deposited into a Certificate of Deposit (CD). The money in the account is FDIC-insured and there is no hard pull on the individual's credit, meaning it does not impact their credit score to open.

The individual then makes monthly payments toward the account, which are reported to all three major credit bureaus. This helps build their credit history. As they make their payments on time, they are also building savings in the account and will be able to track their savings progress on the Self mobile app.

Once the individual has paid off the Credit Builder Account1 in full, they can unlock their savings minus any fees or interest accrued during the payment term.

By using Self's Credit Builder Account, individuals have the opportunity to both build savings and their credit history at the same time.

💡 PRO TIP: Once you make 3 monthly payments on time, keep your account in good standing, and have $100 or more in savings progress you may qualify for the secured Self Visa Credit Card.3

In my opinion, Self is a legitimate company. It was founded in 2015 and is based in Austin, Texas. I have personally used their services and have seen positive results in my credit score.

Self Financial, Inc. is licensed and accredited by the Better Business Bureau, showing that they meet their standards for trustworthiness and transparency. They also have a secure website and use encryption to protect customers' personal information.

Furthermore, Self.inc has multiple positive reviews from satisfied customers on various review websites such as Trustpilot and Consumer Affairs. Many customers praise the ease of use and convenience of the service as well as the helpful customer support team.

Overall, I believe Self is a legitimate and reliable option for those with poor or no credit score looking to build it.

Some potential pros of using a Self Credit Builder Account1 include:

In order to qualify for a Self Credit Builder Account1, the customers must technically apply for a Credit Builder Account. In order to do that, individual borrowers must:

This service reports payments and credit limits to all three major credit reporting agencies. This helps build credit history, as lenders will see a track record of borrowing behavior when evaluating new loan applications. Self reports to each of the three major credit bureaus once a month on the first week of each month.

When applying for a Credit Builder Account1, all loans are subject to ID verification and consumer report review and approval. However, there is no hard pull on your credit, which means applying will not negatively impact your credit score.

The option to set up automatic payments can help make it easier to stay on track with payments and avoid missing any due dates.

The account allows you to track your credit score at no extra cost, allowing you to monitor any progress or improvements in your score over time.

The Self referral program allows you to spread the word and share your unique referral URL with friends and family. You’ll earn $10 each time someone you referred opens a Credit Builder Account1 and makes their first successful plan payment.

One of the main drawbacks of using a Self Credit Builder Account1 is the lack of professional guidance. While it may be cheaper to go the DIY route, you do not have access to a trained credit specialist who can provide personalized advice and assistance. This can lead to mistakes or missed opportunities in building your credit.

Another potential downside is the time and effort required to effectively use a Self Credit Builder Account. It can be overwhelming and frustrating to try and navigate the complex world of credit on your own, especially if you don't have prior knowledge or experience. This can lead to giving up or delaying efforts to build your credit, which can ultimately harm your financial health in the long run.

Overall, while there are potential cost savings with using a Self Credit Builder Account1, it may not always be the most effective option. Consider weighing the pros and cons carefully before making a decision on how to approach your credit.

👀 Related Article: Apps Like Self

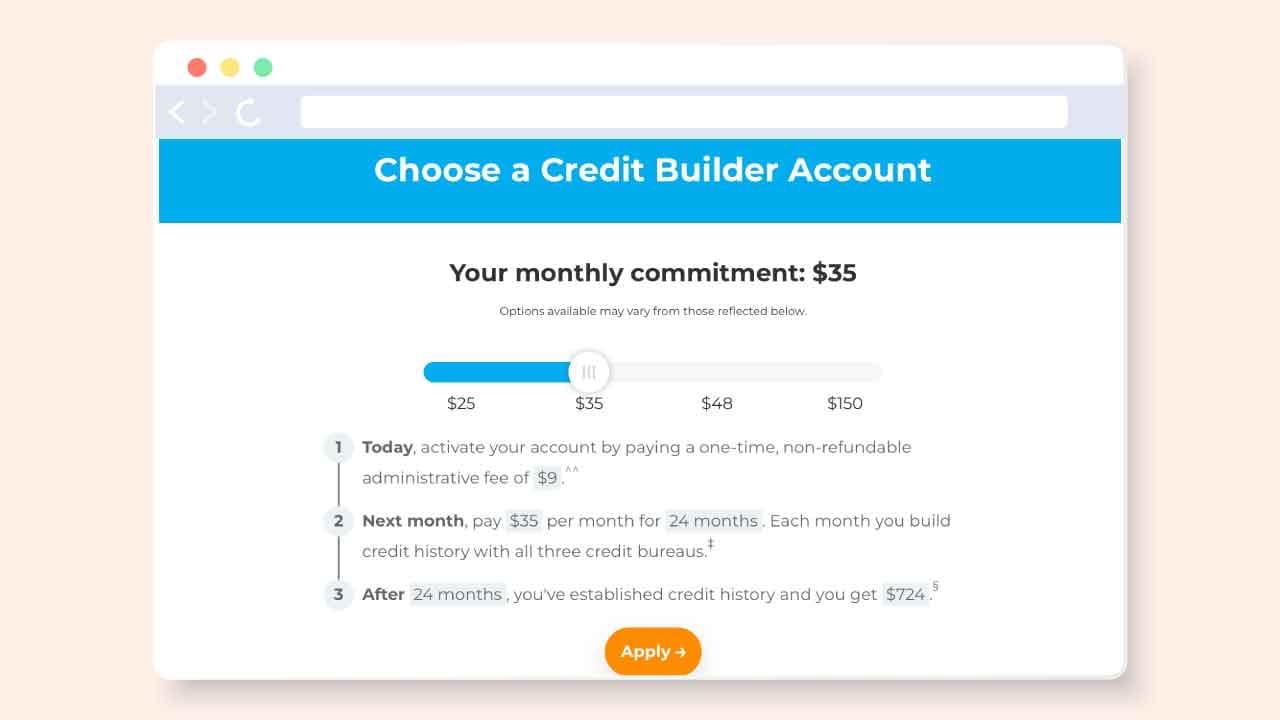

Self offers four credit builder loan plans: the $25 Monthly Plan, the $35 Monthly Plan, the $48 Monthly Plan and the $150 Monthly Plan.4 Each plan has a different Annual Percentage Rate.

This monthly plan has a repayment period of 24 months and an APR of 15.92%.

This monthly plan has a repayment period of 24 months and an APR of 15.97%.

This monthly plan has a repayment period of 24 months and an APR of 15.72%.

This monthly plan has a repayment period of 24 months and an APR of 15.88%.

In addition to the plans themselves, Self also charges a one-time set-up fee of $9 for each plan. There are also late fees if payments are not made on time.

👀 Related Article: Credit Strong vs Self

It would seem that both current and previous users of Self are highly pleased with these mobile applications. The iOS application has received more than 218,000 evaluations from customers, and it has received an overall rating of 4.9 stars out of a possible 5. The Android version of the app has received a rating of 4.7 stars out of a possible 5 from more than 70,000 reviews in the Google Play store.

Below are some positive and negative reviews from the Self Financial BBB account.

In exactly 1 year I went from never having a credit card or car loan (no build credit) to now being pre-qualified to buy my first house. The caveat is that I used a couple other forms of low-risk credit builder accounts and was in constant communication with financially savvy people. I also obtained a well-paying job. Nevertheless, Self was a big part of helping me build credit to where I am today and I never had a credit history until one year ago.

This company is awful!! No contact phone number, only a recorded message and can't leave a voicemail. You can only reach them by email and even then, they don't work weekends. I waited 7 days to get a response from them. You can't talk to a living human being EVER! Very, very badly run company.

To get started, follow our step by step tutorial.

First and foremost, make sure to make all payments on time. This means not only paying off credit card balances in full and on time, but also any bills such as utilities or rent. Consistently making timely payments shows lenders that you are responsible and can be trusted with credit.

Another important factor is maintaining a low credit utilization ratio, which is the amount of available credit that you are using at any given time. It's recommended to keep your ratio below 30%, so try not to max out your credit cards or take on too much debt at once.

Additionally, consider applying for a secured credit card or becoming an authorized user on someone else's account. These options can help establish a positive payment history and build your credit score more quickly.

It's also important to monitor your credit report regularly for errors or fraudulent activity and address any issues as soon as possible.

Overall, building good credit takes time and effort but is worth it in the long run for financial stability and opportunities such as qualifying for lower interest rates on loans or being approved for higher credit limits.

To cancel your Self Credit Builder Account1, you can call the customer service number at 877-883-0999 and choose option 1. You may be asked to verify your identity before proceeding with cancellation. If you prefer, you can also cancel your account through the Self app by navigating to the Account tab and selecting "Cancel Subscription."

Before canceling, it's important to consider whether this is the best decision for you and your credit goals. Overall, carefully weigh the pros and cons before deciding whether to cancel your Self Credit Builder Account.

If you are looking for other credit repair apps, you may be interested in reading our Kovo Credit review and Kikoff review.

It really depends on the individual and their specific financial situation. However, Self's Credit Builder Account1 does report to the credit bureaus, so as long as the user consistently makes on-time payments, they could see a positive change in their credit history over time. Keep in mind activity with other credit you have may impact any positive results from paying your Self Credit Builder Account on time, so results are not guaranteed.

One thing to keep in mind is that building credit takes patience and consistency. It's not something that can happen overnight. It's important to make sure all payments are made on time and in full, as late or missed payments can have a negative impact on your credit score.

However, according to our experience, it generally takes between three and six months to build your credit with the Self Credit Builder Account. You can use the Self app to track your VantageScore from the moment you begin your account.

It is difficult to say exactly how much a Self Credit Builder Account1 may build an individual's credit score, as it depends on a variety of factors such as the individual's current credit history and behavior.

However, according to the personal finance company, the average credit score achieved from a Self Credit Builder Account is 30 points 5, provided the customer makes on-time payments.

Finally, Self does not guarantee any specific upgrade in an individual's credit score, but by using the service to establish and maintain good financial habits, individuals may see a bump in their overall credit.

The Self Credit Builder Account1 is a great product and service for people looking to establish or rebuild their credit. It’s simple to use. We highly recommend giving it a try if you are interested in improving your credit. Have you tried using the Self Credit Builder Account? What was your experience like? Let us know by sending us an email.

1All Credit Builder Accounts made by Lead Bank, Member FDIC, Equal Housing Lender, Sunrise Banks, N.A. Member FDIC, Equal Housing Lender or SouthState Bank, N.A. Member FDIC, Equal Housing Lender. Subject to ID Verification. Individual borrowers must be a U.S. Citizen or permanent resident and at least 18 years old. Valid bank account and Social Security Number are required. All loans are subject to consumer report review and approval. All Certificates of Deposit (CD) are deposited in Lead Bank, Member FDIC, Sunrise Banks, N.A., Member FDIC or SouthState Bank, N.A., Member FDIC.

2Google Play and the Google Play logo are trademarks of Google LLC. App Store, Apple and the Apple logo are trademarks of Apple Inc.

3The Self Visa® Credit Card is issued by Lead Bank, Member FDIC, Equal Housing Lender or SouthState Bank, N.A., Member FDIC, Equal Housing Lender. Individual results will vary. Visit self.inc for more details.

4 Sample products: A loan with a $25 month payment, 24 month term with a $9 admin fee at a 15.92% Annual Percentage Rate with a cost to build of $89; A loan with a $35 month payment, 24 month term with a $9 admin fee at a 15.97% Annual Percentage Rate with a cost to build of $125; A loan with a $48 month payment, 24 month term with a $9 admin fee at a 15.72% Annual Percentage Rate with a cost to build of $169; A loan with a $150 month payment, 24 month term with a $9 admin fee at a 15.88% Annual Percentage Rate with a cost to build of $533. Please refer to www.self.inc/pricing for the most recent pricing options. 5Average outcome for customers who opened a 12 month Credit Builder account in Q1 2021, who made on-time payments, based on Vantage Score 3.0. Other factors, including activity with your other creditors, may impact results. On-time payments does not mean full program completion and past performance based on this study does not guarantee future results. A credit score increase is not guaranteed.

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

How to Lock an Electric Scooter and 5 Best Locks

E-Scooter Locks