Understanding Self Loan: A Way To Build Credit In 2024

Have you ever wished for a way to build up your credit score without any hassle? Self loan can be an effective path to financial freedom and better credit scores. While it is easy to get overwhelmed with the idea of borrowing money, a Self loan could provide a safe and secure way throughout your credit-building journey in 2024. With the right knowledge and resources, understanding how self loan works can give you access to essential money tools that will help you reach your goals faster whilst staying within budget - let's dive into it!

A Self Loan is a type of loan designed to help those with poor credit history to build their creditworthiness. This type of loan is specifically structured with the intention of helping the borrower build credit, better their overall financial standing and build savings.

Often referred to as a “credit builder loan”, this loan comes in the form of a Certificate of Deposit (CD) held in a bank, and it must be paid off in monthly installments. Each payment that is made on time (Selr reports also non on-time payments) is reported to all three major credit bureaus: Experian™, TransUnion®, and Equifax®; which helps establish an individual's credit payment history. Payment history makes up 35% of your overall FICO score, so it’s important that you make payments on time each month.

The goal of a Self Loan is to allow individuals with poor or no credit history to gain access to more favorable terms when applying for larger loans in the future. For instance, if an individual has established a good track record by paying off his/her Self Loan on time each month over several years (or even months), then he/she could qualify for lower rates when taking out loans such as mortgages or car loans. Those with bad or no credit histories often have difficulty qualifying for favorable rates because they don't have enough proof that they can pay back future debts responsibly.

With a Self Loan, these individuals can show lenders that they are reliable borrowers who are capable of repaying future debts in full and on time. Repayments also help better an individual’s debt-to-income ratio, which is another important factor when it comes to getting approved for larger loans like mortgages or car loans.

This ratio compares an individual’s total monthly debt payments with his/her total income per month; if the ratio goes down significantly due to timely repayments from the Self Loan, then there will be more chances of being approved for other types of loans at better terms.

Taking out a Self Credit Builder loan can be beneficial for those who are looking to build their credit history, save money, or both. A credit builder loan like Seedfi or Self is designed specifically to help individuals better their credit and build savings by allowing them to borrow small amounts at a much lower interest rate than traditional loans.

The following are the main benefits of the Self credit builder:

One of the primary benefits of taking out a Self Credit Builder loan is that it helps build positive credit history with the three major credit bureaus: Experian, Equifax, and TransUnion. Taking out this type of loan and making timely payments demonstrates financial responsibility and can have a long-term positive impact on an individual's overall credit standing. Keep in mind that if a customer fails to make a payment, that will be reported as well.

Apps like Self do not require good credit in order to be approved.

Taking out a Self Credit Builder loan compared to other credit building apps, can help you build savings since the principal amount you put in (minus fees and interest) unlocks and comes back to you. This means that if you make all your payments on time and in full over the life of the loan, then all but a small portion of what you borrowed against will come back to you in the end—usually less than 10%—effectively giving you access to free capital while also helping you build your credit at the same time.

To qualify for the Self Visa Credit Card, applicants must have an active Credit Builder account in good standing, with three timely payments and savings progress of $100 or more. Those who meet these criteria will receive a notification of eligibility and can order their card once they’ve chosen how much of their accumulated savings (minimum of $100) they want to allocate as their card’s credit limit. Once received in the mail, it can be used anywhere where Visa is accepted.

Responsible use of the Self Visa Credit Card over time could also lead to potential increases in available credit limits. After six months of responsible use, it may even be converted into a partially unsecured credit card that allows access to additional funds without having to make an upfront deposit. The functionality of this type of card has been designed so that users can get all the benefits of a traditional credit card while still adhering to best practices when it comes to using and managing money responsibly.

👀 Related Article: Kikoff vs Self

Self loans differ from traditional loans in several ways. The first thing to understand is that the Self Credit Builder Account does not offer instant access to the funds. Instead it gives you access to funds once you’ve paid off your loan.

Let’s take a look at the main differences between Self and other traditional loans.

A key difference between self-credit builder loans and traditional loans is the amount of money available for borrowing. With self-credit builder loans, the amount available for borrowing is much lower than with traditional loans; this makes them more accessible for those with poor or no credit history.

The amount available through these types of loans typically ranges from $500-$3,000. By comparison, traditional loan amounts can range from several thousand dollars up into the millions depending on the borrower’s financial situation and ability to pay back the loan amounts within an agreed upon timeline.

In terms of qualification criteria, both types of loans require applicants meet certain eligibility requirements in order to qualify but these requirements vary based on each lender's specific guidelines.

However, Self loans are generally more accessible than conventional loan products due to less stringent underwriting criteria and eligibility requirements – often requiring only basic information such as social security number – compared with what most banks require for conventional loan products (e.g., minimum credit score or debt-to-income ratio requirements).

In order to qualify for a credit building loan with Self you must meet the following requirements:

Traditional lenders may look at factors such as income levels and employment status before offering approval or denying an applicant’s application for either type of loan depending on its own lending policies and risk assessment models used.

Additionally, some lenders may require collateral or other forms of guarantee from both types of borrower before approving any kind of loan applications which could include items such as vehicles or even collectibles in certain cases.

Furthermore, Self offers fast approval times; sometimes as little as one business day after submitting all required documentation required.

Self loans are typically shorter term than traditional loans, with repayment periods of two years, while traditional loans can range from one year up to 10 years depending on the loan type. On the other hand, since Self has shorter terms, it also tends to have higher interest rates than traditional long-term installment loans.

All Credit Builder Accounts made by Lead Bank, Member FDIC, Equal Housing Lender, Sunrise Banks, N.A. Member FDIC, Equal Housing Lender or SouthState Bank, N.A. Member FDIC, Equal Housing Lender. Subject to ID Verification. Individual borrowers must be a U.S. Citizen or permanent resident and at least 18 years old. Valid bank account and Social Security Number are required. All loans are subject to consumer report review and approval. All Certificates of Deposit (CD) are deposited in Lead Bank, Member FDIC, Sunrise Banks, N.A., Member FDIC or SouthState Bank, N.A., Member FDIC.

👀 Related Article: Credit Strong Review

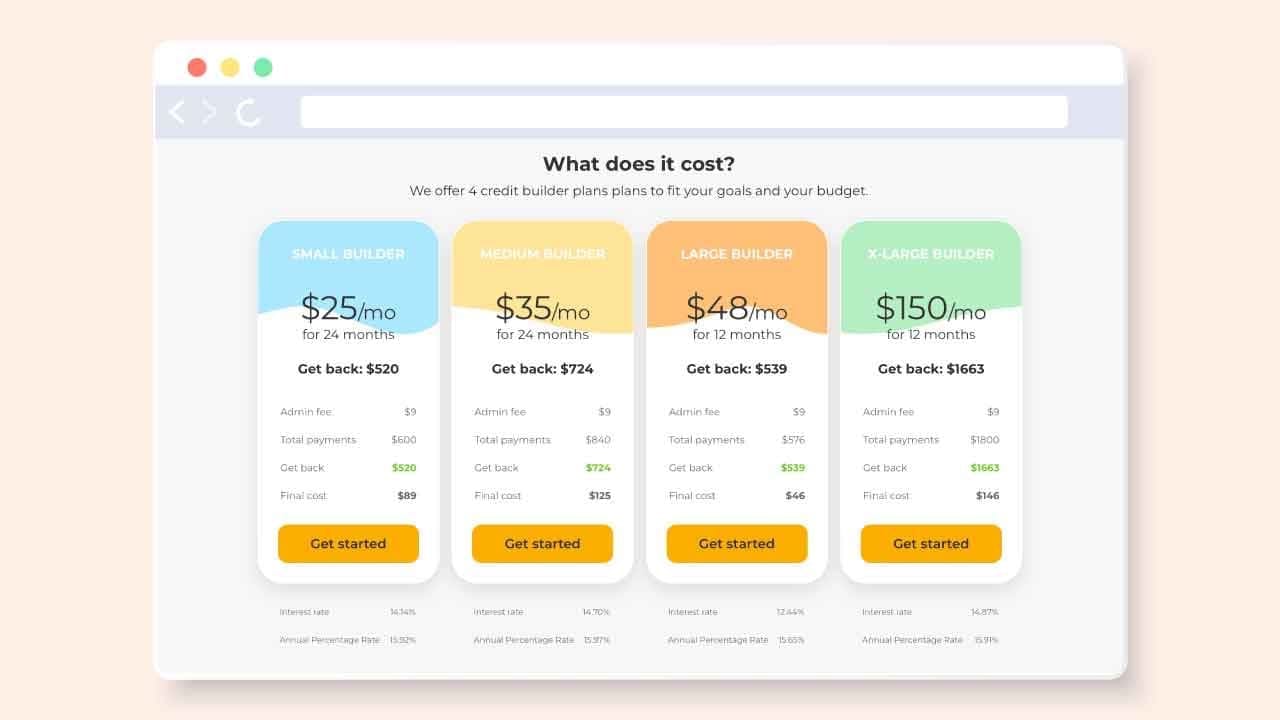

You can choose between different plans. For every plan Self reports to all the three credit bureaus. Sample products:

Please refer to www.self.inc/pricing for the most recent pricing options.

The Self credit builder app is highly rated and has gained positive reviews from users on both the Apple Store and the Google Play Store. On the Apple Store, it has a rating of 4.9 out of 5 stars with over 231,454 reviews from satisfied customers. On the Google Play store, it has a rating of 4.6 out of 5 stars with 73,393 votes from users.

The overwhelming number of positive reviews shows that the app is well-liked by its users for helping them to build their credit score by providing simple tips and guidance in an easy to understand format. It also provides useful tools such as an updated credit score tracker and budgeting advice which can help users elevate their financial health in the long term.

It only took me 35 years to start caring about my credit score, and when I did, it wasn't fantastic. I've used Self for 18 months & apparently, good credit is a thing! Imagine that. They slowly help you help yourself, track your score and offer a credit card option secured by your savings, which was a big help for me. Limits increase as you show positive habits & it's really nice to get those regular "attaboys'' for building your credit, no matter how old you may be! The app is very user friendly.

(Alex - March 3, 2023 - Source Google Play Store)

I may be one of the biggest success stories for self. My score was under 600. Maybe 550 to 575. My score is now 775. I’ve used self for about 3 years and I have mastered the system and I can tell you how also. Only choose the $48 a month option, it makes the most sense with fees. Do the year get the credit card as soon as possible, use the full amount you have available to make the credit limit higher. In your second year what you need to do is pay the 48 as soon as possible.

It says after it’s processed that you can increase your credit limit. Increase it as many times and as soon as possible. So every 30-60 days, your credit will show a balance decrease on the loan and a credit limit increase. The algorithm will love this. Repeat cycle till credit limit is about 1700. But don’t let the money sit there, you must increase the limit as many times as possible. It’s not about the amount of the increase, it’s about how many times you had a credit limit increase. My wife is also doing this and it’s working for her. Self changed my credit for life and now it’s off to the races !!

(Ajdjeowjxbfb, September 10, 2022 - Source Apple Store)

👀 Related Article: Credit Strong vs Self

Applying for a Self Credit Builder Loan is a great way to build your credit. With Self, you can access a loan with no credit history or prior experience needed. Here is a step-by-step walkthrough on how to apply for the Self Credit Builder Loan:

The first step is visiting the Self website and selecting the plan that best suits you. On the homepage, you will see an option to ‘Open an Account’ in the top right corner of the page. This will take you to their application page, where you can select the 24-month program. Once you have selected your desired loan length and amount, click ‘Continue’ at the bottom of the page.

Next, it’s time to provide some personal and financial information about yourself. You will be asked for your name and address, date of birth, Social Security Number (SSN), email address, phone number, and other contact information. You will also need to provide your bank account details so that Self can automatically deduct payments from your account each month. Once all of this has been provided and accepted by Self, you are ready to move onto the next step.

Before finalizing your loan application with Self, an administration fee of $9 must be paid in order to open a Certificate of Deposit (CD) with them which will store all of the loan proceeds until it is paid off in full. This fee is non-refundable.

It is important to note that this fee does not cover any portion of your loan payments—it simply opens up communication between yourself and Self so they can monitor payment activity throughout both repayment periods (24 months).

Once all information has been provided and verified by both parties involved (you and Self), it’s time to review and sign a final loan agreement that clearly outlines what was agreed upon during the application process as well as when payments are due each month over its duration. By signing this agreement both parties pledge that all terms within it will be upheld throughout its lifespan-- 24 months depending on which plan was initially selected-- so it’s important everything is read carefully before agreeing/signing anything!

Now that everything has been finalized between yourself and Self; it’s time to make timely monthly payments according to what was outlined in step four's agreement document until your balance has been paid off completely. For most loans with them, payment amounts range from $50-$150 depending on how much money was borrowed initially with interest rates ranging from 5%-20% annually depending on creditworthiness at time of approval among other factors such as income level etc.. It is important that monthly installments are made on time each month for 24 months consecutively – otherwise late fees could incur which could negatively affect one’s credit score even further if left unchecked!

Finally once all monthly installments have been completed successfully; one should now have access back to their cash via CD held with them (minus any applicable taxes/fees). This money can then be used at their discretion such as paying down high interest debt or investing into other opportunities amongst many other options available out there today! Congratulations on successfully completing your journey through applying for a self builder loan – now let’s go out & enjoy life while managing our finances wisely!

Understanding Self Loan and its ability to build credit in 2024 is an opportunity for those looking for ways to get better interest rates on loans, and access to the best credit cards with a best credit score. In understanding the advantages and disadvantages of using Self loan, individuals can make a legitimate decision about how and whether to use this product responsibly to build credit.

Now you know everything about Self loan and it’s time YOU take action! Explore your options, make a strategic plan, develop smart spending habits, remember that every little step will help create financial wellness over time but also understand that it takes guts to stand up and make that very first investment in yourself – but have courage! For more credit boost tips take a look at our Kovo credit and Kikoff credit review.

1The Self Visa® Credit Card is issued by Lead Bank, Member FDIC, Equal Housing Lender or SouthState Bank, N.A., Member FDIC, Equal Housing Lender. Individual results will vary. Visit self.inc for more details. Card eligibility requirements include having an active Credit Builder Account in good standing, making 3 on time payments and having $100 or more in savings progress. All requirements are subject to change.

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

A Complete List of Gig Economy Jobs

Gig Jobs

How to Lock an Electric Scooter and 5 Best Locks

E-Scooter Locks