Credit Strong Review (2024): An Overview of The Credit App

Whether you're just starting out in your credit journey or are looking to re-evaluate your strategy, Credit Strong is a helpful resource. But what is it? How does it work, and how can you make the most of it? In this Credit Strong review, we'll break down everything you need to know about Credit Strong so that you can decide if it's the right fit for your needs. Stay tuned!

Credit Strong is a division of Austin Capital that helps individuals with a poor or bad credit build and improve their credit score. So, is Credit Strong a loan? No, it is not a traditional lender, so Credit Strong does not give you a loan. A Credit Strong account is a great way to build your credit history and savings at the same time.

Indeed, a credit builder loan is a type of loan designed to help people build or rebuild their credit. These loans are typically small, and the payments are spread out over a longer period of time. For consumers who are trying to raise their FICO score, this may make them more manageable.

The key thing to remember about credit builder loans is that they’re intended to help you build your credit history, not to provide you with quick cash. So, if you’re looking for a personal loan to cover an unexpected expense, this may not be the best option for you.

During the life of your Credit Strong account, you'll be able to build up your credit score with a secured installment loan while having the peace of mind that your savings are safely tucked away in a FDIC insured account.

If you want to find out if installment loans build credit, you have to know that installment loans can help you build credit if you use them responsibly. When you take out an installment loan, the lender will report your borrowing history to the credit bureaus. This will help improve your credit score over time, as long as you make all of your payments on time.

If you're looking for a way to improve your credit score, taking out an installment loan can be a great way to get started on the path to good credit. Just be sure to read the terms and conditions carefully, and make sure you can afford to make all of the payments.

According to their website, they claim that people see an average increase of 25 points within three months, and an almost 40-point increase after nine months. Additionally, they state that if you make all of your payments on time for a year, your credit score can increase by as much as 70 points. This is a significant improvement for your credit and can help you qualify for future loans and other lines of credit.

In a nutshell, credit strong is a program that helps you build your credit history and grow your savings. Here's how it works:

The first step is to apply for a credit builder account with Austin Capital Bank.

First and foremost, in order to get your credit builder loan you have to meet the following requirements:

Unlike other credit building apps, Credit Strong doesn't have an app. To sign up for Credit Strong, simply visit their website and fill out the application form.

From there, you will be asked to provide some basic information about yourself including your name, address, date of birth, and social security number. You will also need to provide your contact information including your cell phone number and email address. Finally, you will need to provide information about your bank account including the account type and routing number.

Once you have filled out the application form, Credit Strong will review it and if approved, they will send you an email with further instructions on how to activate your account.

At this point, Austin Capital Bank secures a small loan in your name by opening a FDIC insured savings account.

You pay off your Credit Builder Account in the specified amount of time.

Credit Strong takes great pride in promptly reporting your payments within 30-60 days of when they are made.

It is critical to make on-time payments since late payments might have a negative influence on your credit score. You have a few alternatives if you are no longer able to make on-time payments:

If you make your payment within 14 days of the due date, you will not be charged a late fee, and the payment will be recorded to the credit agencies as 'on time.' If you make your payment on the 15th day or later, you will be charged a late fee, but the payment may still be made and recorded as on-time. If a payment is approaching 30 days late, you may terminate your account without penalty to avoid a negative impact on your credit score.

You can track your progress through your credit dashboard, which displays a free monthly FICO Score. This can be used as a means to measure your advancement. Most lenders use FICO Scores when making their lending decisions, so this tool is invaluable when trying to improve one's creditworthiness. In addition to viewing your score, you can also see when your next payment is due, monitor the savings you accumulate, and view all other statements and pertinent information.

Once the loan is repaid, you've established credit history and have access to your savings funds. Some users have reported canceling their accounts early and not receiving their money back.

We are a group of experts at BestReferralDriver that are committed to serving our audience. You must understand a crucial concept if you wish to apply for an installment loan.

When taking out a loan, especially a longer-term loan, the borrower pays more interest at the beginning of the loan. This is because the amount of interest charged is based on the remaining principal balance of the loan, not the amount of the monthly payment.

Interest accrues daily between payments. This means that even if a person makes their regular monthly payment, they are still accruing interest on the outstanding balance. Therefore, over time more and more of each payment goes towards interest rather than principal.

Summarizing: The whole point of the Credit Builder Account is to help people who may not have a lot of credit history build up their credit score. This is done by reporting your monthly payments to the three major credit bureaus - Experian, Equifax, and TransUnion. In addition, a portion of each payment goes into your savings account, so you can start building up your savings as well.

👀 Related Article: Grow Credit Review

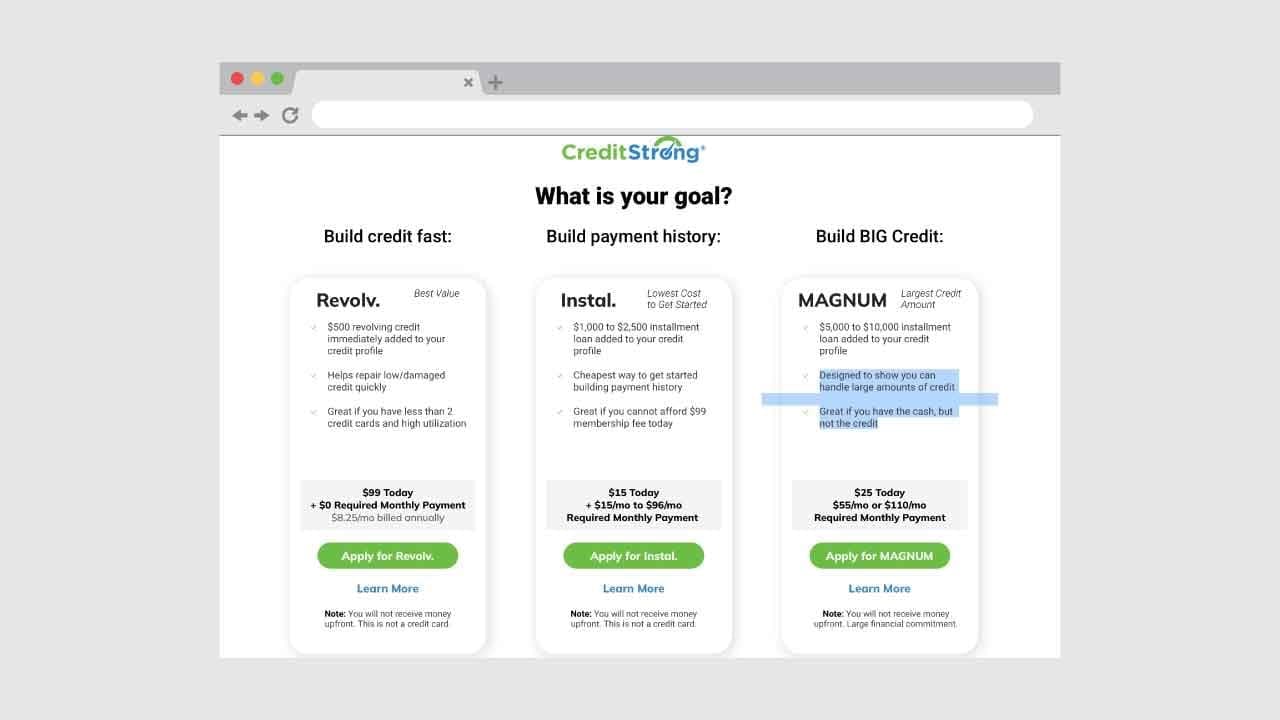

Credit Strong offers a variety of credit products to its customers, including revolving credit accounts, installment credit accounts, and MAGNUM accounts.

A revolving credit account allows the customer to borrow up to a certain limit and then repay the amount over time. The account usually has a lower interest rate than an installment credit account.

This product provides you with an instant addition of $500 in revolving credit to your credit profile.

An installment credit account allows the customer to borrow a fixed amount of money and then repay it over time, usually with monthly payments. The interest rate on an installment credit account is usually higher than on a revolving credit account.

A MAGNUM account is a type of installment credit account that allows the customer to borrow a larger amount of money than is typically available with other installment accounts. The interest rate on a MAGNUM account is usually lower than on other types of installment accounts.

The Magnum product is intended to demonstrate that you are capable of managing significant amounts of credit. If you do not have the credit but do have the cash, this is an excellent option for you.

👀 Related Article: Credit Strong vs Self

There are several advantages to using Credit Strong for credit repair.

Perhaps the most obvious benefit is that you can have your reports sent to all three credit bureaus without undergoing a credit check. This is a great option for those who are concerned about their credit score or have had negative items removed from their report in the past and don't want them to show up on their credit score.

The main advantage of using Credit Strong is that it is incredibly easy to qualify for one of their accounts. They do not have the same strict qualifications as a bank or other lending institution. Additionally, they hold onto your loan proceeds until the account is paid off in full. This allows you to use the money when you need it while still building your credit score at the same time.

Overall, Credit Strong is an excellent choice for anyone trying to raise their credit score. The procedure is simple and might help you improve your credit in less time.

Credit Strong may be a great way to build your credit profile and improve your credit score, but there are also some drawbacks to using the service. First, it can be expensive. The fees for using Credit Strong can be high, and if you're not careful, they can quickly add up.

Second, using Credit Strong may not be effective for everyone. Your credit score may not improve as much as you'd hoped, or it may not improve at all.

Your credit score is calculated by taking into account a number of factors, including your credit mix. This refers to the different types of credit that you have active in your name. Lenders want to see that you can responsibly handle different types of debt, so having a variety of credit accounts will help boost your credit score.

Finally, reading some customer’s reviews , I feel that they did not understand what they were signing up for when they agreed to the terms and conditions of using Credit Strong. The products offered by Credit Strong may not be easy to understand, as they are designed to help people repair their credit. It is important to take the time to read and understand what you are agreeing to before signing up for any credit-related product.

👀 Related Article: Experian Boost Review

Credit Strong is a legitimate credit counseling service. They offer credit counseling and credit education services to consumers who are looking to improve their credit score. Credit Strong also offers a variety of resources to help consumers understand their credit report and how to improve their credit score.

Austin Capital Bank is a five-star rated financial institution with its headquarters in Austin, Texas. Credit Strong is a subsidiary of Austin Capital Bank. Customers who choose to do business with Credit Strong may rest assured that their money is protected thanks to the fact that Austin Capital Bank is a member of the Federal Deposit Insurance Corporation (FDIC).

Overall, Credit Strong is a reputable and reliable credit counseling service that can help consumers improve their credit score.

Credit Strong does not have a credit card. They offer credit builder loans with no credit check, and do not offer credit cards to their clients. Instead, they help their clients rebuild their credit so that they can eventually be approved for a credit card from a different lender. This process can take some time, but Credit Strong is committed to helping their clients get back on their feet financially.

Now that you know that Credit Strong is not a scam, I believe you want to know if it is worth it. The decision to use Credit Strong is a personal one, and there is no easy answer. Some people may find that the credit builder loan is too risky, especially if they do not have a good understanding of how it works. Others may find that the benefits of using Credit Strong outweigh the risks.

Credit Stong can be a great way to build your credit history and credit score. A good credit history and score can help you get approved for loans and other financing in the future. Credit Strong can also help you save money on interest rates.

If you decide to use the service, it is important to make sure you are able to repay your debts on time. Missing payments can damage your credit score and could lead to higher interest rates and fees in the future.

Ultimately, the decision whether or not to use credit is up to you. There are pros and cons to using credit, so it is important to weigh them carefully before making a decision.

Keep in mind that there are other options available as well, so be sure to compare rates and terms before deciding which lender is right for you. Take a look at our guide to Kikoff and Kovo Credit.

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

How to Lock an Electric Scooter and 5 Best Locks

E-Scooter Locks