Credit Strong vs Self: Which is Better for Building Credit?

Are you looking for the best way to build your credit? With so many options and services on the market all claiming to help, it can be overwhelming trying to decide what method is right. To make things simple, let's dive into two of the leading solutions – Credit Strong vs Self. Both have unique advantages that can help you improve your credit score quickly and with minimal effort. In this post, we are going to take a look at how these two solutions compare in order to determine which one is better suited for building credit!

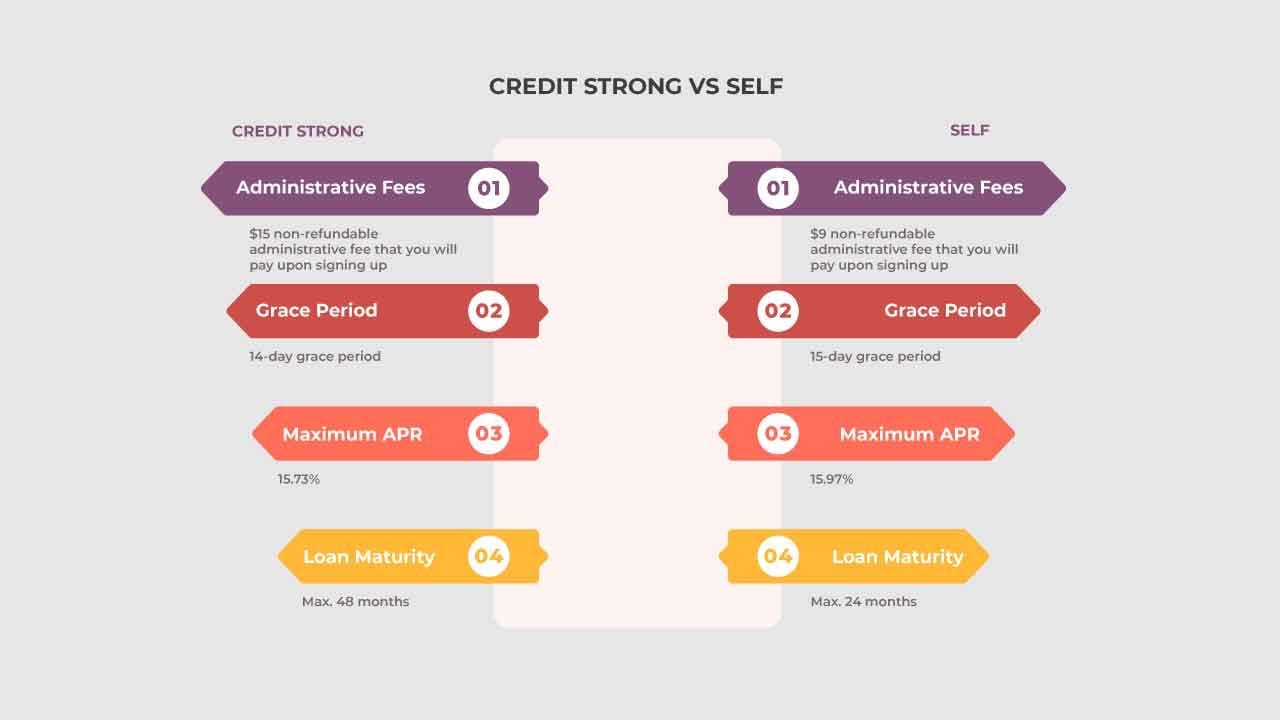

It is critical to understand the similarities and differences between Self vs Credit Strong. Below is a summary of the main similarities and differences between the two credit building apps:

Credit Strong and Self are popular platforms that help individuals build credit and save money simultaneously. Both companies assist individuals in achieving their financial goals, and when it comes to functionality, they share many similarities.

One of the critical aspects of these platforms is that they do not require hard credit checks or inquiries when you apply. This means that anyone can apply and be approved, regardless of their current credit situation. This feature is incredibly beneficial for individuals who want to rehabilitate their credit scores and be on the path to a stronger financial future without any initial hindrances.

When applying for a personal loan Lenders frequently check your credit report when you apply for credit to determine how likely you are to pay on time in the future. Both Credit Strong and Self report to the three major credit bureaus (Experian, Equifax, and TransUnion). It is essential for borrowers to build positive credit histories, and that requires timely reporting of monthly payments to credit bureaus. By consistently reporting on-time payments to these bureaus, both platforms enable their users to demonstrate responsible credit behavior, leading to potential improvements in their credit scores.

Flexibility is another common feature between Credit Strong and Self. Both platforms allow users to cancel their accounts at any time if they no longer require the service. In such cases, customers can receive a refund of their contributions, though some interest and fees may still apply. This flexibility ensures that users are not locked into long-term contracts and can adjust their strategies based on their financial needs.

To help users keep track of their progress, both platforms also offer free credit scores. Self uses the Experian Vantage 3.0 score, while Credit Strong uses the FICO Score 8 from TransUnion. By providing this vital monitoring tool, both platforms help users stay aware of their credit standing and monitor the success of their efforts.

The primary purpose of both Credit Strong and Self is to assist users in building credit and saving money. Both platforms offer solutions that combine the benefits of a secured loan with the convenience of a savings account, helping users build credit histories through consistent, on-time payments. At the end of the account term, users receive a payout of the contributed funds, acting as a disciplined savings mechanism.

There are several key differences between Credit Strong and Self, two popular credit building platforms. These differences can be found in their product offerings, loan amounts, availability, fees, and payment options, among other areas. Here we will delve deeper into these distinctions, offering more details and facts to demonstrate the contrasts between the two companies.

While both Credit Strong and Self offer credit builder loans, Self has taken it a step further by providing customers with their own secured credit card. Once a customer has saved $100, this amount can be used as a security deposit for the Self Secured Visa, which can then be used to further improve their credit scores. This additional offering from Self caters to customers who may prefer a secured credit card over a traditional credit builder loan.

The two companies differ in their available loan amounts, with Credit Strong typically offering larger loans. This can be advantageous for consumers who require a higher amount of capital to improve their credit standing. However, both companies do cater to various financial needs, and it is essential to review individual loan terms and options with each provider.

Self's credit building services are accessible in all 50 states, giving them nationwide reach. In contrast, Credit Strong's services are not available to residents of Wisconsin and Vermont. This can be a crucial distinction for individuals living in these states who are looking to improve their credit scores.

Self generally has lower enrollment fees compared to Credit Strong, making their services slightly more affordable for those starting the credit-building journey. This lower fee structure may be more appealing to budget-conscious consumers looking to improve their credit without incurring excessive costs.

Customers who struggle to make timely payments may find relief with Self's more extended grace period. This allows individuals extra time to gather necessary funds before payments become overdue. A longer grace period can be a valuable and essential feature for those who may experience periodic financial difficulties.

Self stands out by offering the option for customers to make cash payments toward their credit builder accounts for a nominal $2 fee. This can be an attractive feature for individuals who do not have access to traditional banking services or who prefer to conduct transactions in cash.

In summary: Credit Strong and Self both provide valuable credit building services, but they differ in their product offerings, loan amounts, availability, fees, and payment options. Consumers must carefully weigh these distinctions when deciding which company best suits their financial needs and credit-building goals. By understanding the differences between the two platforms, individuals can make informed decisions and choose the right credit builder solution to help them achieve a stronger financial future.

Credit Strong and Self are two credit building apps that offer different yet effective approaches to building and maintaining credit. Both companies strive to equip individuals with the tools and knowledge necessary to enhance their credit profiles and achieve financial stability, ultimately improving access to credit and financial opportunities.

Credit Strong is a division of Austin Capital Bank and a comprehensive financial service platform that focuses on helping users build and maintain a strong credit profile. By offering a unique combination of secure credit builder loans and personalized credit education, Credit Strong aims to improve the financial health and well-being of its customers.

Through its innovative approach, Credit Strong enables users to establish a positive credit history by making timely payments on fully-secured credit builder loans. These payments are reported to the three major credit bureaus, thereby contributing to a better credit score. Additionally, users can access personalized credit education resources and receive real-time credit monitoring on the platform.

Credit Strong's services cater to a diverse customer base, including young adults looking to establish credit, individuals recovering from past credit problems, and those determined to improve their credit standing. By leveraging technology to deliver these services, the platform ensures a seamless user experience, unlocking better access to credit and financial opportunities.

Self is a leading financial technology company specializing in helping consumers establish and build credit through innovative credit building solutions. Recognizing the need for people to access credit and achieve financial stability, Self provides accessible and user-friendly tools to improve creditworthiness and achieve long-term financial goals.

At the core of Self's offerings is the Self Credit Builder Account, which is a unique credit-building product that combines a loan and a Certificate of Deposit (CD). Users make fixed payments each month for a predefined term, and as these payments are reported to the credit bureaus, they contribute to building a positive credit history. Once the term is completed, users unlock the funds in the CD, serving as a valuable savings tool alongside credit building.

Self also offers the Self Visa® Credit Card, which is secured by a portion of the user's Credit Builder Account savings balance, further enabling customers to improve their credit while learning responsible spending habits. Through supplementary resources such as credit education, financial advice, and personalized insights, Self empowers users to take control of their financial lives and navigate the path toward improved credit standing.

👀 Related Article: Kovo Credit Review

When comparing self vs Credit Srong it is important to understand how these credit apps work.

With CreditStrong, borrowers can take out an installment loan which is deposited into a savings account in their name with a lock placed on the funds. Each month, borrowers make one fixed payment of principal and interest to repay the loan. The principal portion of the payment goes towards unlocking the savings account, while the interest portion covers CreditStrong’s costs for providing the service.

The most unique aspect of the Credit Strong account is that it reports borrowers’ loan payments to all three major credit bureaus – Equifax, Experian, and TransUnion – allowing them to build or improve their credit score. This feature sets it apart from other similar programs because not all lenders report payments to all three bureaus. Furthermore, borrowers earn interest on any money left over in the savings account after their loan is paid off; this is essentially free money just for using CreditStrong!

Getting started with the Credit Strong loan couldn’t be easier: you simply apply online or through their app and they will promptly let you know if you qualify for a loan. After that, your funds are transferred into your savings account within two business days and you can start making payments right away. It’s important to note that there are no application fees or pre-payment fees associated with the program, so you only have to worry about your regular planned payments each month – no surprises!

CreditStrong also has several other features designed to make managing your loan as easy as possible. For example, they provide an easy-to-use dashboard where you can view your balance and payment history at any time; additionally, they offer email reminders when payments are due so you never miss one. They even provide helpful advice on how best to use the program so you can maximize its benefits and get ahead of your financial goals faster!

Through the Self credit building savings account, individuals are able to access a loan which is put into a secure, FDIC-insured savings account without having a hard pull on their credit score. This makes it easy for those who may have lower credit scores to access loans and build their credit histories.

The process of obtaining and using the Credit Builder Account is straightforward and simple. When signing up for a Credit Builder Account, individuals are asked to select the amount they will be repaying each month, as well as the term length of 3-24 months. They will then be approved for the loan and funds will be deposited into an FDIC-insured savings account in their name. Self lender then reports all payments made on time to the three major credit bureaus Equifax Experian and Transunion. Each payment is reported as it is made so that users can track their progress towards improving their credit score over time.

With Self plans, users can set up recurring payments from any bank account or debit card directly into their Self Lender account which are then reported to the same three major credit bureaus Equifax Experian and Transunion as previously mentioned.

In addition to offering users ways to improve their credit scores, Self Lender also offers other financial resources such as educational material about personal finance topics like budgeting, debt consolidation and more. The website also offers users videos from experts talking about different financial topics and giving advice on how to make wise decisions with money while also helping them increase their overall financial literacy rate. They even offer personalized recommendations tailored specifically for each user’s situation so that they can receive tailored advice based on what fits them best financially based on data collected throughout the use of the platform.

Credit Strong can be accessed across almost the entirety of the United States, with the exception of Vermont and Wisconsin.

You are able to access Self loans through either our website or our mobile app, regardless of where you reside in the United States.

| Credit Strong | Self Lender | |

|---|---|---|

| Administrative Fees | $15 | $9 |

| Annual Fees | $0 | $0 |

| Late Payment Fees | Credit Strong provides a 14-day grace period from your payment due date. If you make your full payment before 7:00 p.m. Central Time on the 14th day of the grace period and the payment is not returned), you will not be charged a late fee. | Self Provides a 15-day grace period. |

| Maximum APR | 15.73% | 15.97% |

| Length of time | Max. 48 months | Max. 24 months |

In conclusion, when comparing Self Lender and Credit Strong as credit-building tools, it becomes apparent that Self stands out as a superior option for individuals striving to enhance their credit scores more effectively. One significant advantage is Self's secured credit card offering, which not only provides users with a tangible and flexible financial instrument but also adds a layer of diversity to their credit portfolio, thus making borrowers appear more attractive in the eyes of lenders.

Furthermore, Self's extended grace period allows customers more leeway in managing their finances and making necessary payments on time, therefore reducing the risks of late fees and negative impacts on their credit history.

Additionally, Self's transparent and comprehensive approach in providing crucial information to users demonstrates the company's commitment to empowering borrowers, enabling them to make informed decisions and navigate their credit-building journey with confidence. With this considered, it is evident that Self Lender outshines Credit Strong due to its multifaceted approach in supporting individuals to successfully build and maintain a robust credit profile, ultimately making it the more compelling choice for those aiming for financial growth and stability.

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

A complete review of the Revolut app

Revolut

How to Lock an Electric Scooter and 5 Best Locks

E-Scooter Locks