Grow Credit Review (2024): How Does It Work and Is It Legit?

Bestreferraldriver is supported by its audience. We write our articles independently but we may earn affiliate commissions when you use links on this page.

If you're looking for a way to boost your credit score, Grow Credit may be the solution you've been searching for. But is Grow Credit legit? How does it work? In this article, we'll take a closer look at how Grow Credit works and help you decide if it's the right choice for you.

Grow Credit is a financial service that helps its members build their credit by offering an interest-free virtual credit card for them to use to pay their monthly subscriptions. These payments are reported to the three major credit bureaus, allowing members to establish a tradeline on their credit reports for routine payments they’re already making.

In addition to the virtual credit card, the credit boost app also offers personalized suggestions for ways members can improve their credit score, such as applying for a secured credit card or becoming an authorized user on someone else’s account. The basic membership is free, with options for upgraded services at a cost.

One unique feature of the build credit app is its focus on subscription payments as a way to build credit. Many people have monthly subscriptions for streaming services, gym memberships, or other recurring expenses – and by using the Grow Credit virtual card to pay for these subscriptions, they can establish a positive payment history without incurring any additional debt.

Grow Credit works by offering a line of credit that can be used to pay for qualifying monthly subscriptions using a virtual credit card issued by Sutton Bank.

Basically, using the Grow Credit Mastercard, customers can pay their bills for subscription services while also building their credit. Subscriptions includes Netflix, Showtime, Doordash DashPass, Disney, Walmart Plus and more. The card works like an installment loan, where Grow Credit "lends" the customer the money to pay their subscription bills and deducts the payment from their bank account.

To use the card, customers must first link their bank account to the credit boost platform. They can then use their virtual Mastercard to pay for their monthly subscriptions. Grow Credit reports these payments to all three major credit bureaus such as Equifax, Experian and Transunion, helping customers build their credit history.

It is important for customers to make sure they have enough funds in their linked bank account in order to cover payments. If a payment is not able to be withdrawn for 30 days, the credit app will report a late payment to the credit bureaus, which could harm a customer's credit score.

However, because the payments are reported as an installment loan rather than revolving credit, customers do not have to worry about affecting their credit utilization ratio.

Overall, the Grow Credit Mastercard offers a convenient and easy way for customers to build their credit while paying for their regular expenses.

Based on my research and personal experience with Growcredit, I can confidently say that it is a legitimate company.

First of all, Grow was founded in 2018 and is based in Santa Monica, California. The credit building app is backed by well-known venture capitalists and financial companies and it has received funding from notable investors including Blue Ridge Bank and PG Ventures. This shows that reputable organizations have done their due diligence and believe in the legitimacy and potential success of the company.

Additionally, Grow Credit has received positive reviews from both experts and customers. Customers have also reported positive experiences with the company, citing its easy sign-up process.

In terms of safety and security, the company utilizes bank-level encryption to protect users' sensitive information.

Overall, I can attest to the legitimacy of Grow Credit based on the backing of well-known investors, positive expert and customer reviews, and their commitment to secure data protection.

👀 Related Article: Kovo Credit Review

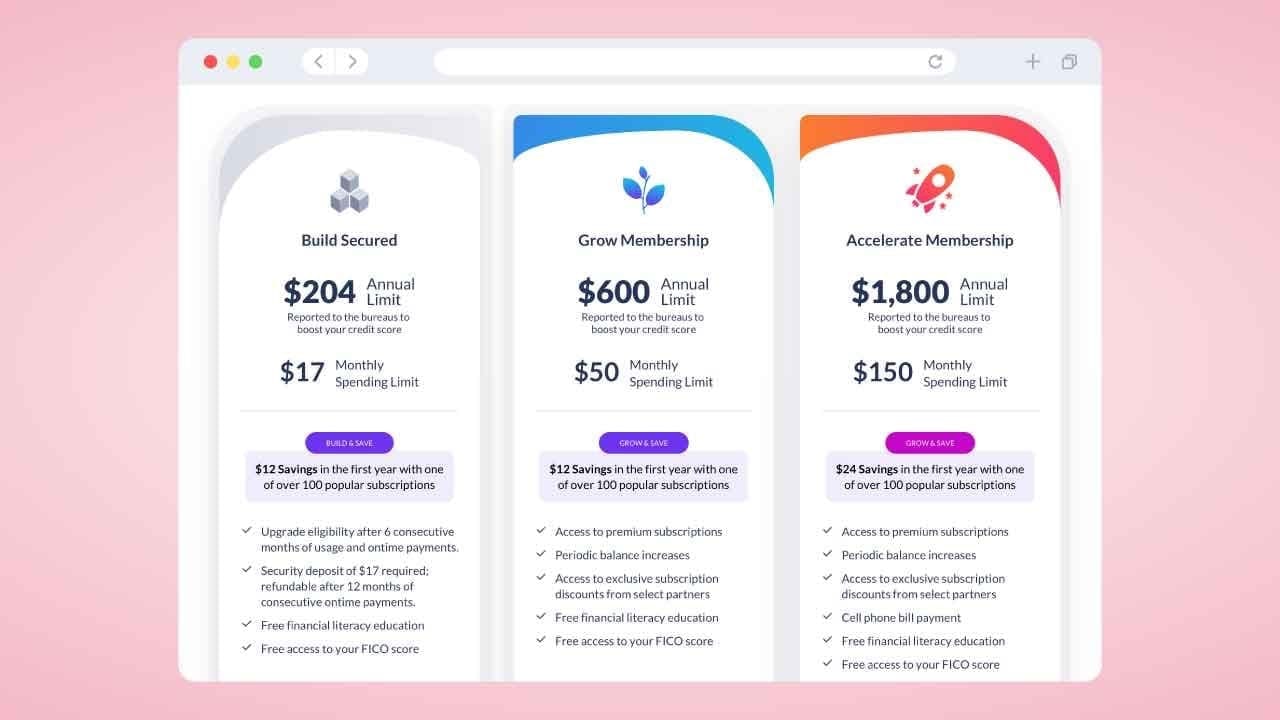

The Grow Credit membership plans offer different options for managing monthly subscription expenses.

Membership plans with varying limits are available, and eligibility is determined by the company.

All plans include access to financial education resources and tools to track spending, set budgets, free access to your FICO score, and improve credit.

Let’s take a look at all the options.

The "Build" plan is free and has a $17 monthly spending limit on popular subscriptions like streaming services. The plan requires applicants to have a qualifying bank account and make a security deposit of $17; refundable after 12 months of consecutive ontime payments.

The "Grow" plan has a monthly fee of $1.99/mo

The "Grow" plan has a higher spending limit of $50 per month and also offers access to premium subscriptions like Adobe, Shopify, Linkedin, and more.

Additionally, the Grow Plan gives you access to exclusive subscription discounts from select partners

The "Grow" plan has a monthly fee of $3.99/mo

The "Accelerate" plan has a higher spending limit of $150 per month and also offers the ability to make payments for premium subscriptions and establish and improve your credit score by consistently paying off subscriptions and cell phone bills.

The "Accelerare" plan has a monthly fee of $7.99/mo.

The following are the main advantages of using this financial tool.

One of the biggest pros of using the credit builder app is the fact that there is no credit check required. This means that those with low or no credit can still have access to this financial tool. Additionally, by linking a bank account, users are able to build their credit while also potentially saving money through avoiding interest charges and fees.

Another pro is that Grow Credit reports to all three major credit bureaus, allowing users to see an increase in their overall credit score.

No matter which plan you will subscribe, the company will report to the 3 credit bureaus the following information:

The background behind Grow Credit is that traditional forms of lending often exclude individuals with poor credit or no credit, as well as charging high interest rates and fees.

The credit building program provides an alternative solution for those who may not have access to other forms of lending. With responsible use and consistent reporting to the credit bureaus, users can potentially see a significant increase in their credit score and have more options for future financial opportunities.

Reporting monthly bill payments will affect your Experian credit file and scores. The average user who sees a credit score increase improves their credit by 13 points.

As a Grow user, I have had the opportunity to use the referral code with my friends and loved the benefits it brought for both parties. Not only did we each receive a $5 credit line increase, but it also helped boost our credit scores.

The process of using the referral code was simple and straightforward. All we had to do was share our unique code with our friend, who then signed up for Grow using that code. Once they were approved for a credit line increase, we both received the credit line boost.

I love that not only am I able to help my friends improve their credit, but I am also able to improve my own at the same time. It's a win-win situation for everyone involved.

I highly recommend using Grow's referral code program to anyone looking to increase their credit line and improve their credit score. It's quick, easy, and beneficial for all parties involved. Give it a try and see the positive results for yourself!

Many subscription-based services are compatible with Grow Credit. This contains well-known brands such as the following:

Some potential cons of using Grow Credit include:

One downside of Grow Credit is that not all banks and credit unions are currently supported through their partnership with Plaid. Basically, when Grow onboards users, they use Plaid to link to a user's bank account, but Plaid does not currently support all banking institutions. However, after onboarding, Grow support other payment methods, including PayPal and debit card manual payments.

If a customer's bank is not supported, they may have to open a new account with a supported bank in order to use the Grow Credit service. This could also mean additional fees or requirements for maintaining the new account.

It's important to keep in mind that Plaid is continually adding new connections, so this limitation may not be permanent. However, for those who need access to a wide range of banking options, Grow Credit may not currently be the best option.

According to our experience, the company has a simple process for users to initiate account closures within the app or by contacting the customer service department. Users will be connected to a live agent who will assist with the process and respond to all closure requests within 24 hours.

However, after reading Grow Credit reviews on reddit, one con of using Grow Credit, according to this reddit user, is their inability or unwillingness to close accounts when requested. This can lead to issues with credit reporting and potentially negatively affecting a person's credit score.

Additionally, the user mentions being charged a monthly fee even when nothing was paid on the account, which can add up over time and be a financial burden.

There may also be potential problems with communication and accuracy, as the user mentions receiving an email stating their account was successfully closed, but then later discovering it was still open and marked as delinquent on their credit report.

Overall, this user's experience with Grow Credit was negative and they do not recommend using the service.

👀 Related Article: Experian Boost Review

In order to qualify for a line of credit, you must meet the following requirements:

Getting started is simple and it will take you only a few minutes. Follow our step by step tutorial.

You can sign up online or download the Grow Credit app from the App Store or Google Play Store.

Connect your bank account and get your virtual Grow card.

You will now know which plan you are eligible for. Choose your subscription, pay on time, and watch your credit score rise.

To contact Grow Credit customer service, you can either utilize the online chat option on their website or reach out through email at behappy@growcredit.com. You can also call their customer service line at 1-888-244-5886.

If you choose to use the online chat option, a real person will be there to assist you with any questions or concerns you may have. For faster assistance, it's helpful to have your account information on hand so that the customer service representative can easily access your account and address any issues.

If you choose to email or call customer service, make sure to include your account information and a clear description of your issue in order for them to assist you efficiently.

Overall, Grow Credit offers multiple options for contacting their customer service team and addressing any questions or concerns you may have regarding your account.

No, paying for Netflix does not build credit. However, if you want to find out how to add Netflix to your credit report you are at the right place. There are ways to add the payments to your credit report.

One option is to use a service like Grow Credit, which connects bills and payments to a secured credit card in order to build your credit history. Another option is to set up automatic bill payments through your credit card or bank account, as these regular payments can also have a positive impact on your credit score.

It's important to keep in mind that consistently making on-time payments is the best way to improve your credit over time, so prioritize paying all of your bills on time each month before seeking out additional ways to add them to your credit report.

If you want to start to build credit with subscriptions, applying for a Growcredit account is the right solution. Overall, Grow Credit offers a useful tool for individuals looking to raise their credit score and establish strong financial habits. It is important to carefully consider all options and research reviews before signing up for any financial product or service. Check out our guide to other apps like Grow Credit if you believe that this personal finance platform is not for you.

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

How to Lock an Electric Scooter and 5 Best Locks

E-Scooter Locks