Klover App Review (2024): Is The Cash Advance App Legit?

Have you ever heard of the Klover cash advance app? It's been making waves lately as a legitimate and easy way to get cash in a hurry. But is it actually legit, and how does it work? In this Klover app review, we'll take a look at the pros and cons of using Klover to get a cash advance or for budgeting.

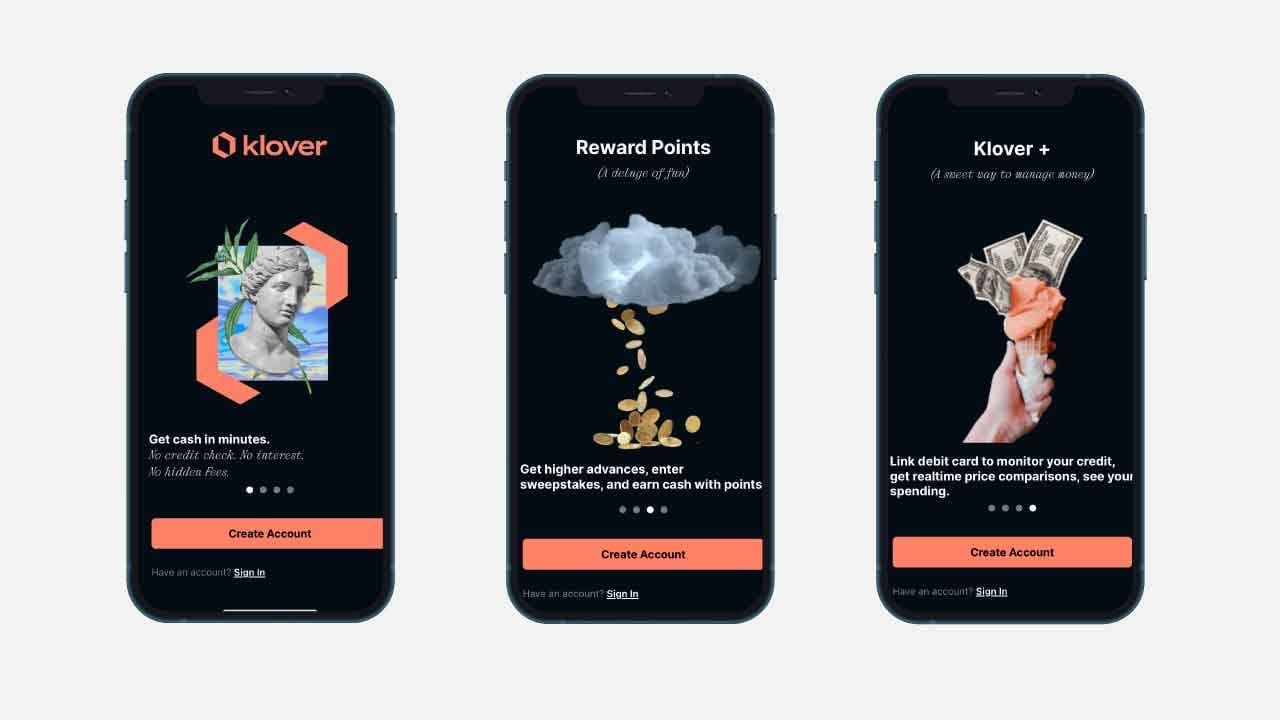

Klover is a free financial app that offers users the chance to take control of their finances. It is designed to help individuals save money, plan for unexpected expenses,and get instant cash advance. With Klover, you can create a budget plan tailored to your needs and track your progress along the way.

Additionally Klover provides short-term cash advances. With the app, you can get a payday loan quickly and easily with no credit check required. The cash advances are unsecured loans that are repaid over a predetermined period of time. You can borrow from $10 to up to $200 depending on your needs and qualifications.

Let’s take a look in detail at the features of the Klover money app.

Klover’s core feature is cash advance. This feature allows you to borrow up to $200 in order to cover immediate expenses or purchase items you have been wanting. Through this feature, users are able to avoid overdraft fees and high-interest rates associated with most traditional payday lenders.

Klover also offers other budgeting tools, which allows you to get an overview of all your financial activities at once.

The app helps you manage income and expenses by showing how much money goes in and out of your account.

Klover can help you achieve long-term financial goals by allowing you to set spend and save goals and earn bonus points when you save money.

The benefits of using Klover go beyond just helping users stay ahead financially; its integrated rewards program gives customers rewards points for every dollar they spend using the Klover Visa® Card. These points can then be redeemed for discounts on future purchases from select retailers or even for donation opportunities with different charities worldwide – allowing customers to give back while still staying within their budget plan.

Klover Plus is a membership program that provides users with access to a variety of financial services and resources.

For just $3.99 per month, Klover Plus members have access to incredible benefits—all designed to give them complete control over their finances.

First and foremost, Klover+ offers its members an experienced financial advisor who can provide advice on all aspects of personal finance, from budgeting to investments. The advisor will look at your spending habits and compare them to others in your spending group, helping you make smarter decisions about where you're putting your money. Additionally, the advisor can help you understand how different financial products work and how you can use them to your advantage.

Another core feature of the Klover Plus program is its real-time price comparisons. By scanning receipts from purchases made in stores or online, the system will crunch the data and display what other people are paying for the same product as you. By seeing this information ahead of time, you'll be able to get the best deal when shopping for what you need. This service helps ensure that our members stay aware of current market prices and get the most value out of every dollar spent.

Finally, Klover Plus offers credit monitoring through Experian—a global consumer reporting agency—so that users can keep track of their credit score daily. Knowing your credit score is important because it affects everything from loan applications and interest rates to insurance premiums and even job applications. With Klover Plus' credit monitoring service, members will have a better understanding of their credit situation so they can make more informed decisions about their own finances.

The answer to the question of whether Klover is a legitimate cash advance and budgeting app is yes. Klover is an innovative financial technology company headquartered in Chicago, IL. This company has been helping individuals and small businesses with their cash flow problems since its launch in 2016.

Klover’s Google Play Store rating is 4 out of 5 stars from over 43,000 reviews while Apple Store rating stands at 4.7 out of 5 stars from 95,453 reviews. This suggests that people are happy with the quality of services they receive from Klover overall. Furthermore, the company is backed by well-known investors such as Silicon Valley Bank, Core Innovation Capital, Mercato Partners, Starting Line, Motivate Ventures which adds another layer of legitimacy to the service they provide.

You do not need a strong credit score to get instant cash advances. Indeed, the financial platform will not run a credit check on you.

In order to be eligible for cash advance with Klovo, there are certain requirements that must be met. Klover cash advance requirements include:

To obtain a cash advance through Klover, applicants must first create an account on the Klover website and download the app, which is available on both the Apple App Store and the Google Play Store.

During the sign-up process they will need to provide personal details and connect their checking account to their Klovo profile. After that is completed they can request a cash advance of up to $200 (subject to change) which will typically be deposited into their connected bank account within three business days upon approval of their application and all necessary documents being provided.

Keep in mind that if you need money right away, you can have it deposited instantly for a fee ranging from $1.99 to $14.98.

Klover doesn’t work with Cash app, Venmo, Paypal or other similar apps.

In order for individuals seeking access to short-term financing through Klovo's services to maximize their chances of being approved for an advance they should meet all of the requirements listed above prior to submitting an application - ensuring all information is accurate and up-to-date as lenders scrutinize applications more closely than ever before in light of recent economic issues due directly related Covid-19 pandemic felt across the country over last few months.

Individuals who cannot demonstrate responsible use of credit products may find themselves denied access without further explanation or insight given why this decision was made - something everyone should keep top of mind prior applying for any marketplace loan programs such as those offered by Klovo's services when seeking access to short term financing options available in today market.

👀 Related Article: How to Make 100 Dollars Fast in a Day

When it comes to customer support, Klover is quite different from other companies. Instead of providing its customers with a phone number or an email address, they only offer a ticket system through their help website. In order to open a ticket and get assistance from the customer care team, there are three simple steps you need to take.

First, you must provide your 10-digit phone number associated with your Klover account. You don’t have to worry about including any symbols; just be sure to type in all 10 digits without any spaces or dashes. Second, you will be asked for the name associated with your account and finally, enter the email address linked with that same account as well.

Once you complete these steps, the customer service team at Klover will review your query and reach out shortly thereafter either via email or on the phone if necessary. Whether you have a question about billing or technical problems related to your account such as login issues, Klover's customer support team is available 24 hours per day 7 days a week during normal business hours and offers fast responses so that their customers' needs can be addressed quickly and efficiently.

Klover also provides users with an extensive library of resources via their help website which includes informative articles with step-by-step instructions on how to use certain features within their platform as well as troubleshooting advice if you're having trouble getting things working properly. Additionally, members of the customer service team blog regularly so that users can remain up-to-date on all of the latest news regarding new product updates and enhancements - something that no other company does nowadays!

Overall, if you're looking for an efficient way to contact Klover's customer support team then opening a ticket using their help website is definitely an option worth considering. The process is quick and easy as long as you remember to include all relevant information such as your phone number, name and registered email address when submitting your query - this will ensure that they can reply back promptly without any delays due to incomplete information provided by the sender!

👀 Related Article: Apps Like Klover

Troubleshooting the Klover app can sometimes be a challenge. Recently, I have been getting an error message and experiencing an issue with the app not working correctly, resulting in a black screen when I open it.

If this occurs, I have found that uninstalling and then updating the latest version gives me the most success. Sometimes closing out of all other apps on my device can also help. Managing these simple steps can sometimes resolve any issues and make sure to get back on track with my app usage.

Finally, use Downdetector to see if there is an app outage.

Klover is one of the cash advance apps that work with Chime, the online banking platform that offers banking services without bank fees.

Chime is a great option for those who need quick access to cash due to the ease of use. Chime users can quickly apply for Klover instant cash in just a few clicks. Once approved, the customer will receive their funds directly into their Chime account within minutes. Customers also have the option of choosing how they would like to repay their loan—either with a lump sum payment or through monthly payments over a set period of time.

When it comes to safety and security, Klover puts a lot of effort into protecting its customers’ data. All customer information is stored securely on the company’s servers using SSL encryption technology.

However, while Klover is a safe and trusted platform, it is important you know that Klover has partnered with renowned financial institutions in order to leverage insights from your data. Klover collects your data necessary for their services, but also to provide you with relevant ads to you.

Klover ensures that all customer data remains anonymous and secure. This means no one outside of Klover’s team will be able to see or access any of your personal information.

Overall, Klover’s cash advance feature provides users with an easy way to meet short-term financial needs without having to put themselves at risk by taking out high-interest loans or relying on credit cards that often come with hidden fees or even higher finance charges over time.

Additionally, its comprehensive suite of budgeting tools provide users with tools they need to customize and stick to individualized plans while its reward program helps users build even further incentive towards living within a tight budget while striving towards greater long term financial stability.

However, if you are uncomfortable sharing our personal data we suggest you use other apps like Brigit or Rocket Money for budgeting. Remember that starting a side hustle that pays the same day is the best way to make money quickly.

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.