Brigit App Review (2024): How Does It Work, And Is It Legit?

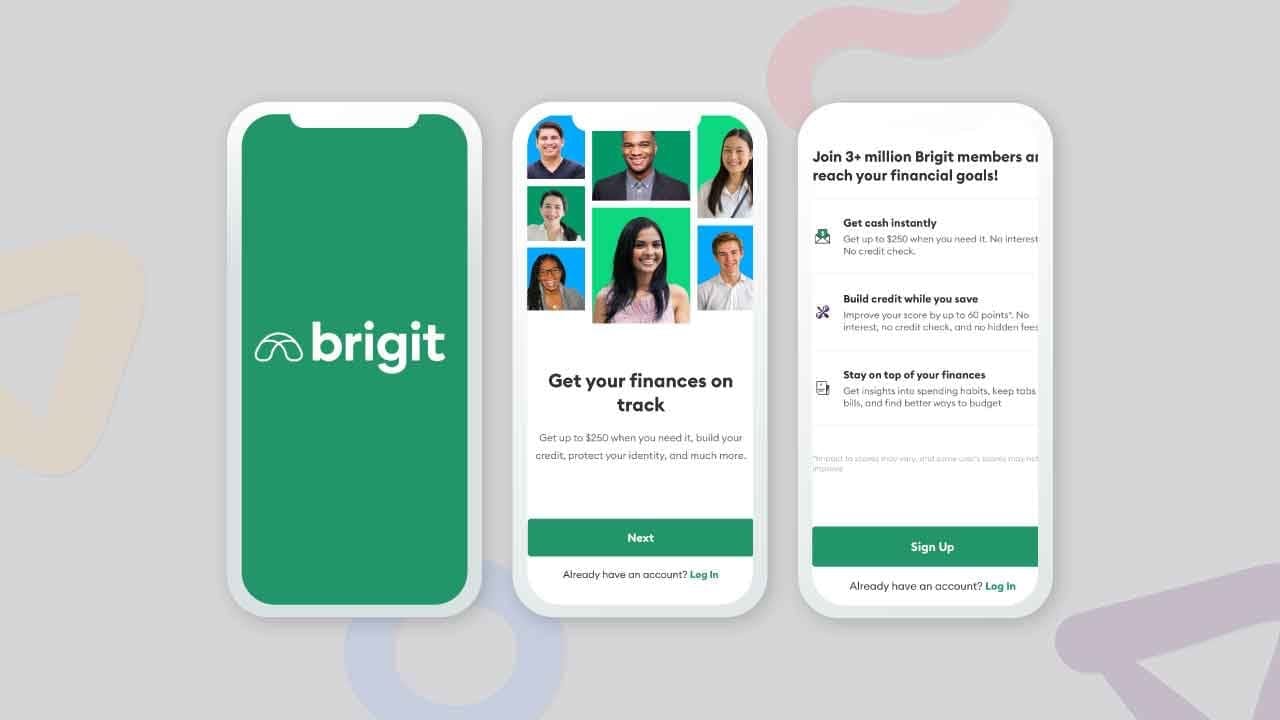

Whether you are looking for a payday loan app or a credit building app, you may have come across the Brigit finance app. But is brigit legit? How does it work? In this in-depth Brigit app review, we'll take a look at how the app works, and whether or not it's a scam.

The Brigit app is a financial health tool that offers small-dollar paycheck advances, as well as budgeting and credit-building features. There is a free version of the app that includes some financial advice and budgeting tools; but, in order for users to use the advance and credit-building features, they need to pay a monthly membership fee of $9.99.

One of the main goals of Brigit is to help people save money, improve their finances and reduce financial stress. The app offers several features to help people do this, including a budgeting tool that helps users track their spending and find areas where they can cut back. Brigit also offers a “skip-a-payment” option, which allows users to postpone one payment each month without penalty. This can help people avoid getting into debt or over their heads financially.

Brigit also helps people build their credit scores. The app has a credit-building feature that allows users to see their credit score and makes it easy to track progress over time.

Indeed, the app monitors your credit score and alerts you if there are any changes, so you can take action quickly if necessary. This is a great way to stay on top of your credit rating and protect yourself from financial damage.

This can also be helpful for people who are trying to get their finances in order or who want to buy a home or car in the future.

Finally, identity theft is a serious crime that can have long-lasting consequences for the victim. This is why Brigit offers identity theft protection to its users. If your identity is stolen, the financial health app will reimburse you for the expenses incurred as a result of the theft. The app will also help you cancel and replace lost ID and credit cards.

If you are concerned about the possibility of identity theft, consider downloading the Brigit app or connecting to Brigit.com. The website allows you to login and manage your account. With Brigit's identity theft protection, you can rest assured that you are protected in the event of a theft.

Overall, Brigit is an innovative and helpful app that can make a big difference for people struggling with their finances. It’s easy to use and has a range of helpful features, making it a great choice for anyone looking for more control over their money.

Yes, Brigit is a legitimate app and it has received positive ratings and reviews from users on the App Store and Google Play Store. The company was founded in October 2017 by Hamel Kothari, Len Kunin, and Zuben Matthews and is headquartered in New York.

It is a FinTech that has 18 investors including Community Investment Management and Lightspeed Venture Partners.

Now that you know the company is legitimate, I'm sure you're curious about how the Brigit app works. The app offers two distinct products.

To use Brigit as a cash advance app, you must first be approved for a personal loan with no credit check required. The approval process is simple and takes only a few minutes. Once you are approved, you can use the app you can use the app to start a loan request and get cash quickly.

Brigit is one of the quickest and easiest ways to get cash when you need it and avoid overdraft fees and late payments. You can get money anytime, anywhere. Additionally, there are no hidden fees. The only cost associated with using Brigit is a monthly fee of $9.99.

Brigit is a safe and secure way to get cash when you need it. The app uses high-level security features to protect your information. Additionally, the payday loan app never shares your personal information with third parties.

If you need money fast, Brigit is the perfect solution. The app is quick, easy, and affordable. Plus, Hellobrigit offers high levels of security and privacy protection.

👀 Related Article: Apps Like Earnin

The Brigit loan app is a credit builder app that helps users improve their credit score. The app works by helping users track their credit score, provide tips on how to improve their credit score, and providing access to credit building loans. The loans offered through the momey borrow app are designed to help users build up their credit score so that they can eventually qualify for traditional loans.

One of the main benefits of using the Brigit app is that it allows users to track their credit score. This is important because it allows users to see where they need to make improvements in order to increase their credit score.

The app also provides tips on how to improve your credit score. This is helpful because it provides users with specific instructions on how they can improve their credit score.

Finally, the credit boost app offers access to credit building loans. These loans are helpful because they allow users to borrow money and then repay it over time. This helps build up the user's credit history and eventually improves their credit score.

Brigit is an amazing budgeting tool that enables users to gain financial insights quickly and easily. With Brigit, users can set up their budgets in only a few minutes. Apps like Brigit provide users with insights into their spending habits by delivering personalized reports on how much they're spending and where their money is going each month. With these financial insights, users can identify areas where they are overspending and take steps to reduce costs or save more money over time. Finally, Brigit allows users to stay accountable by setting a goal tracking feature so they can keep track of how close they are to meeting their savings objectives every month.

👀 Related Article: Kikoff Review

Follow our step by step tutorial

You can get started with Brigit right away by installing the app on your mobile device by going to the Apple App Store or the Google Play Store. The next step is to register for an account and connect it to your bank account.

When you sign up for Brigit, you provide your checking account information. The company then reviews your account to see if you qualify for a cash advance.

To qualify for Instant Cash, your checking account must meet the following criteria:

Brigit will set up a payback date for you and put the money into your account if you are eligible for the program. After that, you'll have to pay the membership cost, but you'll also have the option to get a paycheck advance.

Brigit will notify you 2 days before your payment is due. You can also choose to pay back the advance early. If you have any questions about the process, you can use the in-app chat feature or customer service line.

👀 Related Article: Solo Funds Review

Referring to the customer reviews of Brigit, it can be seen that the app has generally received positive feedback. The app has an average of 4.8 of 5 stars from 193.5k ratings on the Apple App Store and 4.6 of 5 stars from 93k ratings on Google Play Store.

The company is not BBB accredited but they answered to all complaints. However, Brigit reviews on BBB are useful resources for finding information about products.

The good news is that most of the Brigit lender reviews do not complain about the products. The bad news is that there are many complaints about the customer service.

One customer said, “Emailed numerous times about an issue with their credit builder app, and was given zero assistance. Brigit has no customer service line and their chat bot claims you will get a response. I got very generic and incorrect responses. They suggested I click on their credit button on the app and click make a payment there is no such make a payment button.

Brigit FAQ states that a failed payment can be rectified by making a payment within 30 days. There is no option to actually do this. The response in an email I finally got stated they don't let you make up the payment and to contact my bank but that's not what their own site says. This is going to affect my credit score which is the sole reason I've set up an account with this company. Extremely unprofessional and takes no responsibility.”

One of the most beneficial choices for payday advances is the Brigit App, which allows users to borrow up to $250 without subjecting them to a credit check or charging them interest. In addition, Brigit offers a variety of additional tools, such as credit monitoring, tracking of budgets, and credit-builder loans.

The fact that you have to pay a recurring cost of $9.99 per month in order to access the majority of the services is the only significant drawback. In order to make use of Brigit, you furthermore need to have access to the activity of your bank account. Due to the fact that the Brigit advance is not as large as those offered by some of its rivals, it is recommended that you look into other opportunities before enrolling.

👀 Related Article: Cash Advance Apps for Gig Workers

Both Brigit and Earnin are mobile applications that provide customers with the opportunity to get cash advances in the form of smaller amounts between paychecks; nevertheless, there are significant differences between the two.

Brigit will lend you cash advance up to $250, whereas Earnin will lend you up to $500 if you decide to take out a loan from them. Additionally, in contrast to Earnin, Brigit does not force its users to record and report the number of hours they put in at work.

While it does not cost anything to use the Brigit app, users of the Earnin app are asked to leave a tip ranging from zero dollars to fourteen dollars for each cash advance they get, and the service also charges up to three dollars and ninety-nine cents for quicker financing periods.

Overall, Brigit and Earnin offer similar services but with some key differences. Brigit is more accessible with a lower loan amount and no work hour tracking requirements, while Earnin offers a higher loan amount and requires work hour tracking. Additionally, the Brigit app is free to use while the Earnin app charges a tip and shorter funding time fees.

Cash advances are made available by both Brigit and MoneyLion Instacash, although the maximum amount that may be borrowed via Brigit is just $250. In addition, Brigit provides customers with the option to open investment accounts, mobile banking accounts, and credit builder loans. If you pay a charge for rapid delivery, funding may be sent to you in as little as one business day.

Cash advances of up to $300 are available to approved customers via MoneyLion Instacash. This is $50 more than what is available through Brigit. MoneyLion Instacash also provides credit builder loans, mobile banking accounts, and investment accounts. If you pay a charge for rapid delivery, funding may be sent to you in as little as one business day.

👀 Related Article: Albert App Review

When it comes to the delivery time for the cash advances, there are two options: 1. Get cash in 1-3 Days or 2. Get cash Instantly. The first option means that the cash will be deposited into your account within 1-3 business days. The second option means that the cash will be deposited within 20 minutes of requesting them. So, if you need money right away, instant delivery is the way to go.

Keep in mind though, that you will need to qualify for this option by meeting certain requirements, such as having a bank account with a certain bank or being a member of specific credit unions.

PRO TIP: Brigit doesn't work with Cash App, Varo, Chime Bank and Net Spend

If you don't repay Brigit on your repayment date, you can extend it by going inside the app and using an extension credit. If you've ran out of extension credits, they will automatically give you another credit once you pay back 2 advances in a row without using any extensions on them.

Brigit is worth it for people who need a short-term solution for covering emergency expenses. The paycheck advance feature can help you cover unexpected costs without having to borrow money from friends or family. Additionally, Brigit offers credit-building and budgeting features that can be helpful for people who are trying to improve their financial situation.

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

How to Lock an Electric Scooter and 5 Best Locks

E-Scooter Locks