Is Brigit Credit Builder Right for You? Get the Full Review

Are you looking for a way to improve your credit score without having to shell out hundreds of dollars each month? If so, look no further than Brigit Credit Builder! It’s an innovative tool available from the financial app provider Brigit that lets you effortlessly increase or maintain your current credit rating. Through flexible payment options, users can take full control over their financial standings. In today's blog post, we'll be taking a deep dive into this service to help you determine if it's right for you. Keep reading to explore how Brigit Credit Builder works, its benefits and drawbacks, what kind of savings are possible through using it and much more!

A Brigit Credit Builder Loan is a financial tool designed for individuals who seek to improve their credit scores. This concept originated to cater to those who are struggling with poor credit history and are striving to secure better financial futures for themselves.

The credit builder loan is a loan product that is specifically designed to facilitate the borrower in their efforts to create a positive credit history. This loan helps borrowers to establish and build their credit, while also offering them financial assistance. Credit Builder loans are typically small loans with low-interest rates, varying from a couple of hundred to a thousand dollars.

This loan product is an excellent option for people who are young or have not yet established a credit history. Without a credit history, it becomes challenging to get approved for traditional loans, credit cards, or rent an apartment. Building a credit history can significantly improve one's financial standing and increase their chances of qualifying for loans, credit cards, and other financial products.

The Brigit Credit Builder Loan is a simple and straightforward loan type, with an easy application process. The majority of the loan applications are processed online, and the loan approval process is quick. The borrower can choose the repayment terms and schedule that best suits their needs, meaning this loan product is highly flexible.

Furthermore, a Brigit Credit Builder Loan is an excellent option for those who may not have an ideal credit history or have had a financial emergency in the past. Approval rates for this loan product are generally high, and lenders typically do not perform a hard credit check, which doesn't have any impact on the borrower's credit score.

Finally, very similarly to other credit building apps , Brigit also offers financial education and support services for individuals looking to improve their credit scores. These services may include credit counseling, debt management, and budgeting guidance. These additional resources alongside loan products, can be helpful for borrowers to manage their finances and improve their financial literacy.

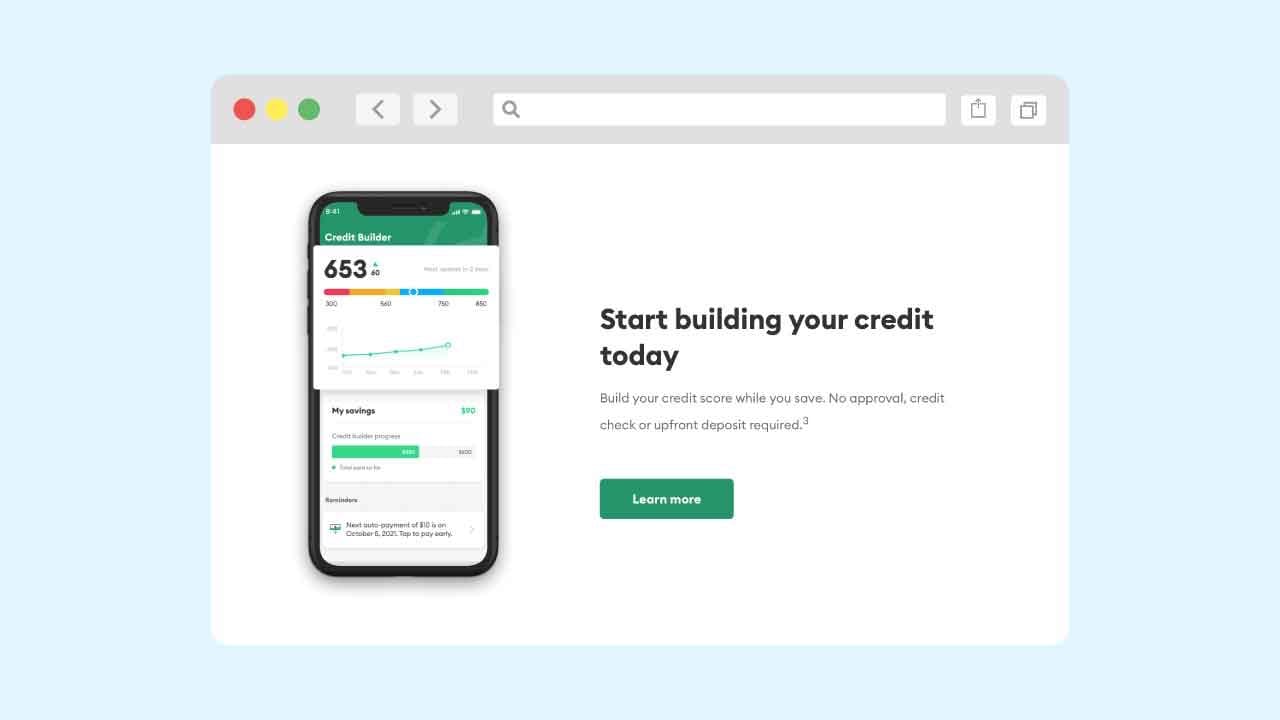

If you want to establish a positive credit history and build your savings at the same time, Brigit's credit builder loan is an excellent alternative to traditional loans. Here is how it exactly works:

To begin, you must open a credit builder account and connect your checking account to it. This is done entirely online, the Brigit app is available to download on the Apple App Store or the Google Play Store. After downloaded the app you can complete the application process in minutes.

At this point, depending on your bank account activity, Brigit will assign you a “Brigit score and this without performing a credit check. .

Once you have connected your account, you will be able to set up the loan, the process of building credit starts.

With the credit builder loan, the money you borrow is not available to you right away; instead, it is held in a savings account for a set amount of time or the loan term. The amount you can borrow and the loan term vary depending on your credit profile and financial history. Typically, the loan term is 24 months, giving you ample time to build credit and establish better financial habits.

As soon as you make your first loan payment, Brigit will begin reporting to all three major credit bureaus: Equifax, TransUnion, and Experian. This means that your on-time payments will be reflected on your credit report, helping to establish positive credit history.

It is important to note that any late payments on your credit builder account may result in negative reporting to credit bureaus by Brigit. This, in turn, can significantly harm your overall credit score. Additionally, it is worth noting that once you have established a recurring automatic payment amount for your credit builder account, you will not be able to modify the payment amount. These are factual and important details to consider when managing your credit builder account.

Here is how exactly the repayment works. The total payment is divided into 24 equal installments. Users make payments on the loan through two parts.

The credit builder loan helps to diversify your credit profile, which accounts for 10% of your credit score. This is the perfect opportunity to add an installment loan to your credit mix, which can help to boost your credit score.

The contributions you make towards the monthly payments are all encapsulated in full, and this sum is returned to you once the loan is fully repaid. Suppose, hypothetically, that you obtained a loan of $600. In this event, the loan should be returned in 24 equal installments of $25 per month, but you determine an amount to pay per month of say $10, then the remaining $15 is paid from the Coastal Community Bank account.

After the completion of the 24-month financial cycle, there will be a total of $240 deposited into the account, and this sum will, of course, be refunded back to you, indicating the culmination of the loan repayment agreement.

A Brigit Credit Builder Loan offers numerous benefits to those who are seeking to improve their credit score.

One of the primary benefits of a Brigit Credit Builder Loan is its ability to help borrowers build credit. By making on-time payments and paying off the loan in full, borrowers can establish a positive credit history with the credit bureaus. This, in turn, can lead to better credit scores and more favorable rates on future loans and credit lines.

Another benefit of a Brigit Credit Builder Loan is that it comes with no-interest rates. Unlike traditional loans that charge interest, Brigit charges no interest on its loans. This can help borrowers save money on interest fees and pay off the loan more quickly.

Moreover, a Brigit Credit Builder Loan is a subscription-based service that gives users access to all of the company's features. This includes financial health monitoring, instant cash advances, and overdraft protection. By subscribing to Brigit, borrowers can take advantage of all these features and improve their overall financial situation.

There are a few things to keep in mind when it comes to Brigit's credit builder loan. Firstly, you must make your payments on time every month to establish a positive credit history. Secondly, the loan term is fixed, so you will be obligated to continue making payments until the loan term comes to an end. Lastly, the loan amount and loan term will vary depending on your credit profile.

If you are looking to build your credit history, there are several credit builder loans available in the market. Among these, Brigit Credit Builder Loan stands out for its affordable subscription fee of just $9.99 per month. It also offers additional benefits like budgeting tools and cash advances. In this article, we will compare Brigit Credit Builder Loan with other credit builder loans to help you make an informed decision.

Self is another popular credit builder loan provider that charges a one-time fee instead of a monthly subscription. While Self does not charge any interest, it has an annual percentage rate (APR) of between 15.72% and 15.92%, depending on the plan you choose.

An advantage of Brigit over Self is the availability of budgeting tools and cash advances. Brigit's app allows you to track your expenses, set budgets, and receive alerts when your account balance is low. You can also access cash advances up to $250 without any interest charges or fees. Self, on the other hand, does not offer any such features.

Comparing Brigit Credit Builder Loan and Self, we can see that Self is the more affordable option. With the subscription fee, Brigit can become quite expensive, especially if you do not need the payday loan feature or the budgeting tool which are available for free on apps like mint. On the other hand, with Brigit, you do not have to worry about interest charges, which can add up quickly over time.

Kikoff is a line of credit that allows you to build credit by making monthly payments of $5. Unlike Brigit, you cannot withdraw funds from Kikoff, and there is no interest or fees charged. However, Kikoff does not provide any other benefits like budgeting tools or cash advances.

Comparing Brigit Credit Builder Loan and Kikoff, we can see that Brigit is the better option if you need access to funds. With Brigit, you can withdraw cash advances up to $250 without any interest or fees, which can be helpful in an emergency. Kikoff, on the other hand, only allows you to build credit by making small monthly payments.

Another advantage of Kikoff over Brigit is the affordability. Kikoff only charges $5 per month, it does not offer any other benefits. Brigit, on the other hand, charges a bit more at $9.99 per month but provides access to budgeting tools and cash advances.

Brigit Credit Builder is indeed a legitimate service. It is a program offered by Brigit, a reputable financial services company with a strong track record of helping individuals manage their finances. Brigit Credit Builder aims to help users establish and improve their credit score by reporting their payments to credit bureaus. This not only helps individuals build good credit, but also paves the way for better financial opportunities such as lower interest rates and higher credit limits. Moreover, Brigit Credit Builder is backed by top financial institutions and is recognized by the Better Business Bureau, which further solidifies its credibility and trustworthiness.

Absolutely, you can cancel your Brigit Credit Builder membership at any time. It's important to note that prior to canceling your membership, your Credit Builder Plus loan must be paid in full. Once your loan is completely paid off, there are no cancellation fees or penalties for canceling your membership.

Canceling your Brigit Credit Builder membership is a straight-forward process that can be completed directly through the app. Simply navigate to the "Profile" section, select "Membership," and then click "Cancel Membership." You'll be given the option to confirm your cancellation before it's processed.

It's worth noting that canceling your Credit Builder Plus loan early may impact your credit score, so it's suggested to keep the loan open until it's completely paid off. Additionally, if you choose to cancel your membership, any remaining funds in your Credit Builder Plus account will be disbursed to your connected bank account within 10 business days.

After thorough research and analysis, our team of experts has reviewed Brigit Credit Builder and here are our findings.

The Brigit Credit Builder Loan has proven to be a reliable tool for borrowers with poor or no credit histories, as well as those seeking to improve or establish their credit. As with any loan product, borrowers must ensure that they understand the terms and conditions of the loan to avoid any potential financial issues. Finally, always remember that improving one's credit score takes time, effort, and patience.

This is a great feature for those looking to improve their credit score as it provides greater visibility and accuracy to potential lenders. However, it is important to note that while late payments are unlikely, they are still possible and could negatively impact your credit score.

One of the standout features of Brigit Credit Builder is that it does not charge interest. This means that users don't have to worry about accruing debt or paying additional fees beyond the monthly fee. However, the monthly fee is quite expensive, and users should consider this cost before committing to the app.

Overall, Brigit Credit Builder is a reliable and effective app for those looking to improve their credit score. It offers reporting to all three credit bureaus, has a no-interest policy, and supports the goal of avoiding late payments. We encourage users to explore other credit-building apps before deciding which one to commit to, but Brigit Credit Builder is certainly worth considering.

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

How to Lock an Electric Scooter and 5 Best Locks

E-Scooter Locks