8 Apps like Mint: Alternatives for Budgeting & Lower Bills

Bestreferraldriver is supported by its audience. We write our articles independently but we may earn affiliate commissions when you use links on this page.

Are you looking for alternatives to Mint for budgeting and lowering your bills? You are in luck! There are plenty of other options out there that can help you manage and track your finances. In this blog post, we will be discussing five different apps like Mint that offer features such as automated payments, bill reminders, debt management tracking, monthly budgeting tools and more! Read on to discover which app is the best fit for meeting your needs during financial planning season.

QUICK ANSWER

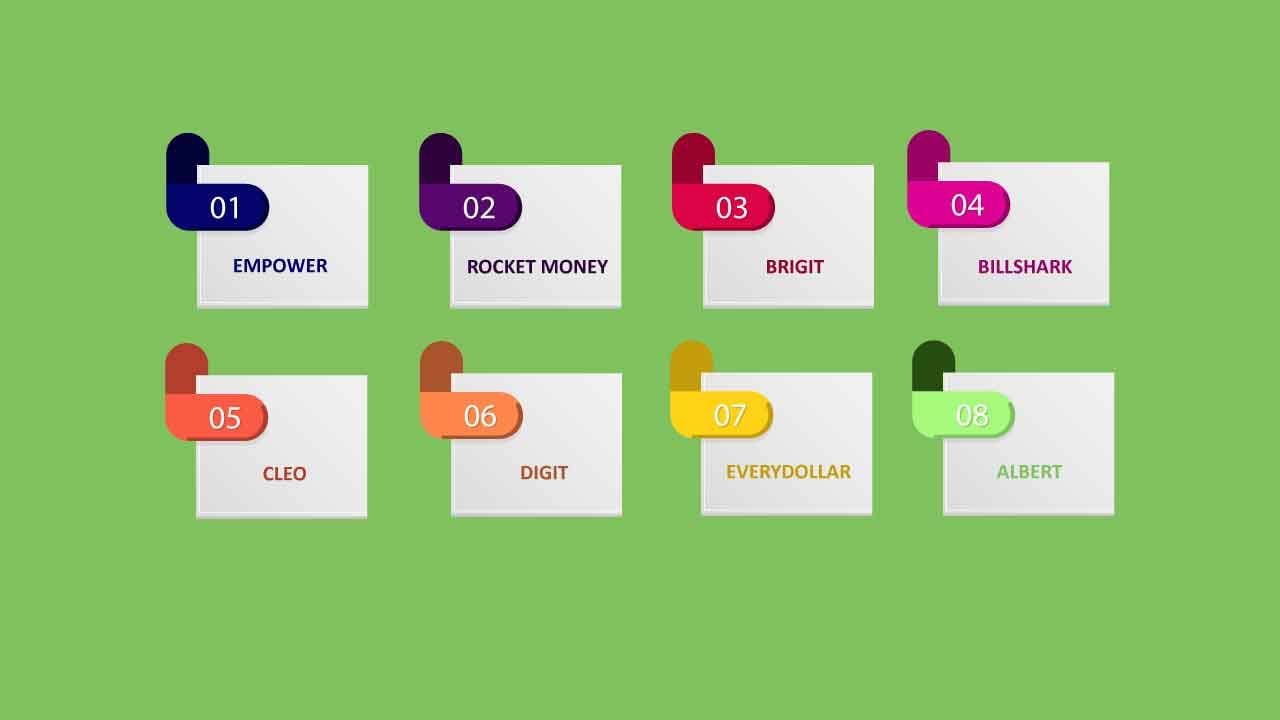

Find below a complete list of all the apps like Mint ranked and reviewed:

When it comes to personal finance management, apps like Mint have revolutionized the field. These apps help users track their expenses, set budgets, and plan for the future in a way that is easy and accessible. However, there are a few key things you should know about these apps before diving in.

First and foremost, it's important to understand how these apps make money. While the app itself is often free to use, companies like Mint make money by partnering with financial institutions and offering their users targeted financial product recommendations. This can include things like credit cards, loans, and insurance policies. As such, it's important to be aware of the potential for biased recommendations and to always do your own research before taking action based on the app's suggestions.

Another important factor to consider is the security of your personal financial information. While most reputable personal finance apps use encryption and other security measures to protect user data, there is always a risk of your personal information being compromised. It's important to read the app's privacy policy and take steps to protect your own data, such as enabling two-factor authentication and regularly changing your passwords.

Finally, while these apps can be incredibly useful for tracking your finances and planning for the future, it's important to remember that they are only a tool, and not a substitute for sound financial planning and decision-making. It's important to have a solid understanding of personal finance basics, such as budgeting and saving, in order to make the most of these apps and ensure a secure financial future.

In order to choose the best apps similar to Mint, we embarked on a rigorous and thorough process of evaluation and selection. Firstly, we carefully analyzed the overall purpose and functionalities of the Mint app. We looked at what made it the go-to choice for millions of people who sought to manage their personal finances effectively.

Next, we went on to conduct a comprehensive study aimed at comparing and contrasting the features and usability of various other apps in the market. To achieve this, we recruited a diverse group of participants who satisfied certain predetermined criteria. These criteria included owning a smartphone and having an interest in personal finance management.

The recruited participants were then tasked with trying out the various apps over a designated period of time, while providing feedback on aspects such as ease of use, overall design, and unique features. The study was conducted with a high degree of rigor, ensuring that all participants had sufficient time to get acquainted with the apps, and that their feedback was accurately captured and analyzed.

Through this meticulous process of evaluation and selection, we were able to identify the apps that were the most useful and user-friendly for managing personal finances. These apps were evaluated against Mint on various criteria, such as ease of use, reliability, affordability, and robustness of features.

Finally, we arrived at a carefully curated list of apps that were considered to be the best alternatives to Mint for users seeking intuitive and effective personal finance management tools. This list was informed by the feedback provided by our participants, as well as our own rigorous evaluations of the apps. We are confident that the apps we have selected will provide users with the powerful and user-friendly functionality that they require to manage their personal finances effectively.

When it comes to financial management, Mint is a well-established app that has been popular for a long time. However, there are some new contenders in the market that are giving Mint a real run for its money. If you're on the lookout for a new financial management app to help you manage your budget and expenses in 2024, then you'll want to check out some of the best alternatives that are currently available. Here we will discuss some of the top Mint alternatives and provide a detailed overview of each app, along with a checklist of pros and cons.

Personal Capital is a popular Mint alternative that offers a comprehensive financial management experience, with features suitable for managing both personal and business finances. Personal Capital offers a robust platform for tracking expenses, budgeting, investment management, and retirement planning. The app also comes equipped with a feature that allows you to monitor your net worth.

Rocket Money is a simple yet effective budgeting app that offers a great user experience especially useful for small businesses such as gig workers. The app allows you to categorize your expenses and create a budget based on those categories. Additionally, Rocket Money provides various tools like goal-setting services to help you reach your financial targets more effectively.

They also have a paid version called Rocket Money Premium which gives you access to other tools such as automatically identifies your subscriptions and cancel them, identifies bill payments and saves money with bill negotiation.

Brigit is a financial management app that offers a free version with basic budgeting tools. The app allows you to create a budget, track expenses, and receive alerts when you're about to overspend. Brigit also offers cash advances to help you avoid overdraft fees and a credit builder to help you bump your credit score.

Billshark is a unique app that specializes in helping you negotiate better deals on your bills, such as cable, phone, and internet service bills. The app works by analyzing your bills and identifying potential savings opportunities, then negotiating those deals on your behalf.

Cleo is an AI-powered financial management app that offers a unique way of managing your finances. The app offers a chatbot interface, which allows you to interact with the app using natural language and receive instant feedback on your spending patterns. In addition, the app offers personalized insights and recommendations to help you manage your finances better.

Digit is another personal finance app that offers a unique way of managing your finances, with an emphasis on saving. The app analyzes your spending patterns and transfers small amounts of money to a separate account to help you save automatically. Digit also offers insights that help you understand your spending habits and make better financial decisions.

Everydollar is a top-tier finance app that offers a powerful and intuitive platform for users to manage their finances effectively. With its comprehensive features and functionalities, Everydollar has become an excellent choice for many individuals and families looking for better ways to manage their money.

One of the most notable features of Everydollar is its ability to help users set and achieve their savings goals. The app provides a wide range of tools and resources that enable users to create and customize their savings goals based on their unique financial needs.

In terms of money management, the app offers a variety of features that make it easy for users to track their income, expenses, and investments in real-time. With the ability to sync with bank accounts, credit cards, and other financial institutions, Everydollar offers a seamless and hassle-free way to manage your money.

Albert is a remarkable personal finance management app that has taken the market by a storm. Designed to be an all-in-one financial assistant, Albert does everything you need and more. The app revolves around the concept of helping you save money and better manage your finances in a user-friendly way.

One of the primary features of Albert is its advanced investing tools. Thanks to its unique design, Albert allows you to invest your money in an effortless way. It will recommend different options for stocks or other types of assets that match your specific preferences and needs. Whether you are looking to invest in the stock market or bonds, Albert will provide comprehensive information on the different options available.

Another significant feature is its ability to track your net worth. This is an incredibly useful tool that allows you to monitor your net worth in real-time. With Albert, you can easily view all of your accounts, including checking accounts, savings accounts, and even your credit card accounts. This helps you know exactly where your money is, what your expenses are, and how much progress you have made in your savings goals.

Finally, Albert allows you to connect all your financial accounts in one place. Once you connect your accounts, the app will begin categorizing your spending and give you a clear understanding of where you are spending your money. This makes it easier to identify areas where you can cut back on spending and allocate the money saved to other savings goals.

Due to the sensitive information they hold, it's essential to ensure that the app is secure and reliable. Mint, for example, uses bank-level encryption security and is verified by trusted sources to maintain the highest level of protection. Lastly, it's crucial to evaluate your personal financial goals and long-term plans to see if an app like Mint can assist you in achieving them. With these considerations in mind, you can make an informed decision about whether an app like Mint is the right choice for you.

In conclusion, there are several Mint alternatives to consider when it comes to managing your finances in 2024. Each of the above apps has its strengths and weaknesses, and it is up to you to decide which app would be the most appropriate for your particular financial management needs. The key is to choose the app that offers the features and services that best align with your long-term financial goals.

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

How to Lock an Electric Scooter and 5 Best Locks

E-Scooter Locks