Cleo App Review (2024): What Is It and How Does It Work?

If you're looking for a comprehensive Cleo app review, you've come to the right place. In this article, we'll discuss what Cleo is, how it works, and whether or not it's a good fintech solution. In this Cleo review we'll also provide some tips on using the app to help you get the most out of its features!

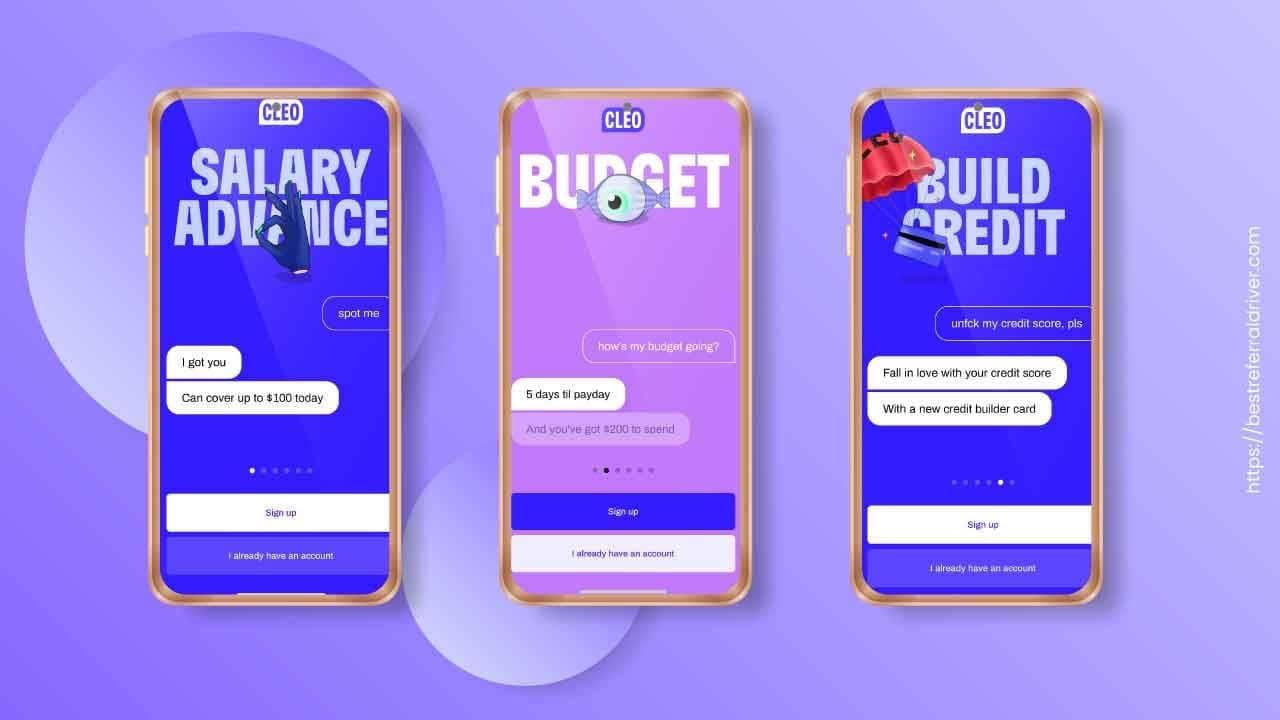

The Cleo app, also known as Meet Cleo, is a chatbot that helps people take control of their finances in an easy and fun way. With a freemium business model, Cleo provides users with sound financial insights that aim to change their spending behaviors in order to facilitate better money management and help users save money.

Cleo Money app was founded in 2016 by Barnaby Hussey-Yeo, and the app started operations in the UK. However, as of February 2022, Cleo announced that the app will no longer be downloadable in the UK. If you're an existing user, you'll still have access to the app, but some features won't be available. Cleo is focusing its efforts on the US market.

One of Cleo's primary goals is to help people become more financially responsible. The app does this by providing users with insights into their personal finances, which can help them make better spending decisions. Additionally, Cleo aims to make money management more fun and engaging through its chatbot interface.

Since its inception, Cleo has received positive feedback from users and has helped many people get their finances in order. With its focus on the US market, Cleo is poised for even more success in the coming years.

For those considering using Cleo, it's important to first understand what the app is and what it can do. The U.K. founded personal finance app is a banking and budgeting app that offers a variety of features to help users manage their money.

These features include:

A budget planner that helps users track their spending and stay on top of their finances: Cleo allows users to see all of their transactions in one place, set budgets, and track their progress over time.

Money saving: The app also offers a "smart savings" feature that rounds up each purchase to the nearest dollar and saves the difference. This can help users save money without having to make any extra effort.

Cleo may provide you with a no-interest advance of up to $100 to assist you in staying out of your overdraft. You choose the payback date (anywhere between 3 and 14 days)

Let’s take a look in detail at all the features of the app.

Cleo Credit Builder and Cleo Credit Builder Card are products offered by the Cleo banking app. They offer an easy and affordable way for people with limited or no credit history to build up their credit score.

The Cleo Credit Builder Card is a prepaid Visa card that helps people establish or rebuild their credit history. It has no annual fee and no interest rate. To get the card, you need to sign up for the Cleo Credit Builder program and make a deposit of at least $100. The card can be used anywhere Visa is accepted.

Both the Cleo Credit Builder program and the Cleo Credit Builder Card can help you improve your credit score if you use them responsibly. Building your credit score can help you get approved for a loan or a mortgage when you need it, and it can also help you get a lower interest rate on those loans.

👀 Related Article: Best Credit Building Apps

Tired of the payday loan debt cycle? With this helpful app, you can break free from predatory lenders and enjoy a life without interest payments!

Cleo is one of the cash advance apps like Earnin. A cash advance app can help you get a salary advance or avoid overdraft fees. You can borrow money from Cleo (up to $100 interest free). The $100 cash advance feature of the app is so valuable – it allows you to get your hands on your money as quickly and easily as possible.

With just a few taps on your phone, you can have the cash you need to cover an unexpected expense or tide you over until your next payday.

The cash advance feature is not available to all users of the financial management app, but only to Cleo Plus and Cleo Builder members who pay a monthly fee. (However, you do receive additional benefits like credit building and rewards.)

The best part? There's no need to go through credit checks or a long and complicated application process – all you need is a Cleo account and a paid membership.

The basic Cleo Cash Advance requirements include:

And if you're worried about interest rates or fees, don't be – Cleo doesn't charge any interest on cash advances, and there are no hidden fees.

Your eligibility and the amount you are eligible for is based on your transaction and deposit history and patterns.

Cleo advances through a tiered system, with the amount you can borrow increasing as you repay your initial loan. The lowest tier is $20, and the highest is $100. Typically, first timers qualify for $20-$70 dollars. Once you have successfully repaid your loan and completed a set number of tasks (usually around 3-5), Cleo will advance you to a higher amount - up to $100.

So if you're in need of some quick cash, make sure to use the app's cash advance feature. It's fast, easy, and affordable, and it can help you get through a tough financial situation.

Cleo Plus Cash Advance is one of the quickest and easiest ways to borrow a small amount of money. Funds are usually transferred within 3-4 business days. This makes it a great option for last-minute payments or when you need money fast.

If you need money right now you can pay $3.99 express fee for same-day funding

👀 Related Article: Cash Advance Apps for Gig Workers

The budgeting feature is a great way to keep track of your spending habits. The app will recommend a budget for you, but you can always adjust it to fit your needs. You can set a budget for different categories, such as groceries, dining out, and entertainment. The app will then monitor your purchases and notify you when you are getting close to your budget limit. This is a great way to stay within your budget and avoid overspending.

Cleo is a free app that helps you save money and track your progress. One of the best features of the AI-powered app is its ability to round up purchases to the next dollar. This means that if you purchase something for $4.75, Cleo will automatically round that up to $5 and deposit the extra 25 cents into your savings account. This is a great way to passively save money without having to do anything extra!

Additionally, if you want to save money you can use the app to move money between your bank account and Cleo Wallet. So even if you don't have any extra cash lying around, you can still use Cleo to save money.

Another great feature of the Cleo finance app is its Spend Tracker. The Spend Tracker allows you to see where your money is going each month. This is helpful in identifying areas where you might be able to save more money. For example, if you see that you're spending a lot of money on groceries each month, you might want to consider cutting back on your grocery spending. Or, if you see that you're spending a lot of money on entertainment, you might want to think about ways to reduce your entertainment budget.

Overall, this budgeting tool is an excellent way to save money and track your progress. It's easy set-it-and-forget-it savings hacks make saving money effortless, and its Spend Tracker lets you see where your money is going so that you can make informed decisions about how to save even more. If you're looking for an easy way to get your finances on track, then the app is definitely worth checking out!

👀 Related Article: Revolut Review

Yes, Cleo is a legit app. It's an AI-powered assistant that helps you save money and manage your finances. The app has been featured in Forbes, Mashable, and other major publications. It's been downloaded by over 500,000 people and has a 4.6-star rating on the App Store.

Most users have had positive experiences with the app, while some others have found that it doesn't quite meet their needs. Overall, Cleo is a helpful tool for budgeting and tracking expenses, but it may not be suitable for everyone.

Cleo is a personal finance assistant that connects to your bank account and tracks your spending. It then gives you insights into your spending habits and provides advice on how to save money. Cleo also has a built-in chatbot that responds to questions about your finances.

The app is available for both Android and iOS devices. To start using the service, download the app and create your account. You will be prompted to connect your bank account, credit card or debit card to Cleo.

One of the benefits of using Cleo is that it can help you become more aware of where your money is going each month. This can be especially helpful if you're trying to stick to a budget or save for a specific goal. Cleo also offers automatic categorisation of expenses, so you can see how much you're spending on things like groceries, transport, or entertainment.

Cleo is the perfect way to take control of your finances and save money.

While Cleo does offer some great features, there are a few things to keep in mind before deciding whether or not to use it. First, the app requires you to input your bank login details, so it's important to be comfortable with sharing this information. Second, Cleo isn't perfect - it has been known to make mistakes when categorizing expenses and some users have found its advice to be unreliable.

Overall, Cleo is a handy tool for budgeting and tracking expenses, but it may not be suitable for everyone. If you're interested in giving it a try, be sure to read up on its features and decide whether the benefits outweigh the risks.

There are three plans for Cleo: Free, Cleo Plus for $5.99 per month, and Credit Builder Secured Credit Card for $14.99 per month.

The Free plan includes Building a budget you might actually pay attention to, Effortless bill and spending tracking, Savings goals and monthly targets, and Cleo Chat to help you stay on track, whether that’s through roastin’ or toastin’.

The Cleo Plus plan for $5.99 per month includes all of the features of the Free plan, as well as Up to $100 in no interest, no credit check cash advances, Credit score coaching and analysis, and Cashback offers on restaurants, retail, travel, and even gas and groceries!

The Credit Builder Secured Credit Card for $14.99 per month includes all of the features of the Cleo Plus plan, as well as a Credit Builder Secured Credit Card. This card requires a minimum deposit of only $1.

👀 Related Article: Apps Like Cleo

Yes, Cleo is safe. The app has been designed with safety in mind, and your personal information is protected. Cleo does not store your bank login details, and all communication between you and your bank is encrypted.

If you have any questions or problems with the service, you can contact Cleo Customer Service by email. The email address is team@meetcleo.com. You can also find answers to common questions on the Faqs website at https://faqs.meetcleo.com/. If you need help from human support, you can chat with them on the website.

Now that you know everything about the Cleo app, it’s time to decide if it’s right for you.

The app is safe and free and can help you budget and save money.

If you want to build credit and don’t mind paying the Cleo builder subscription, then the app is definitely worth checking out. With its user-friendly interface and helpful support team, you can be on your way to better credit in no time! If you want a cheaper way to build credit, take a look at our guide to Kovo Credit and Kikoff.

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

How to Lock an Electric Scooter and 5 Best Locks

E-Scooter Locks