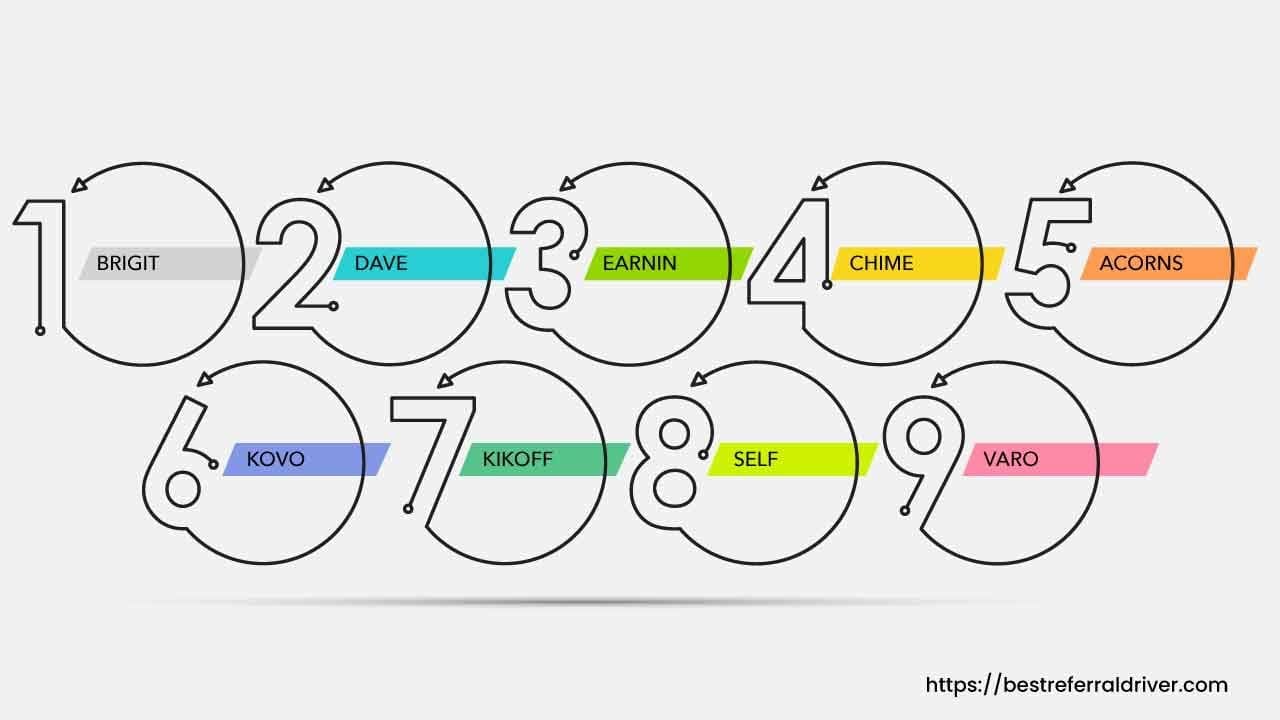

9 Apps Like Moneylion: Alternatives for Cash Advance & Loans

If you're looking for an app that can provide you with cash advances, credit loan services, and investment services, Moneylion is a great option. However, there are many other apps like Moneylion that might better fit your needs.

Whether you need money for an emergency or just want to build up your credit score, one of these apps can help. In this blog post, we will discuss some of the best alternatives to Moneylion. We will also talk about how each of these apps work, so you can decide which one is right for you!

Find below some of the best apps like Moneylion that can help you take control of your finances and achieve your financial goals. These apps offer a variety of features such as budgeting tools, investment options, and more, making it easier than ever to manage your money on the go.

Brigit is a credit builder app and a cash advance like Moneylion that can help you get the money you need quickly. When you need cash fast, Brigit is the best option. With Brigit, you can get a cash advance of up to $250 instantly or in as little as 2-3 business days for no fee. You don't even have to go through a credit check to get your cash. All you need is an active bank account and a job that pays regularly.

When it comes to your finances, Brigit is the perfect way to keep track of it all. Not only does Brigit offer instant cash, but it also provides a number of valuable features such as credit reports and identity theft protection. This makes Brigit an essential tool for anyone looking to better understand their spending and earning trends, as well as protect their identity from fraud.

Dave is a mobile app that connects users with short-term loans, typically for small amounts of money. Loans are available to users with good credit, and the company offers an easy application process and fast approval times.

Similar to Moneylion, the app also offers a variety of features to help users manage their money, including budgeting tools and access to financial education resources. Dave is one of the best apps like Moneylion, as it offers a simple and convenient way for users to get the money they need quickly, without having to go through a credit check or pay any late fees.

When it comes to emergency expenses, we all know that the last thing we want is to have to wait for our next payday to come around in order to get the money we need. This is where a cash advance from Earnin comes in.

Earnin is a cash advance app like Moneylion that allows users to get a small amount of money transferred to their bank account within minutes.

With this service, you can borrow up to $500 per pay period, which can help you cover expenses like car repairs, unexpected bills, or even groceries.

To get a cash advance from Earnin, all you need is an internet-connected device and a bank account. You can request a cash advance online or through the Earnin app, and you'll receive the money within minutes. There's no credit check required, and you don't have to pay any interest on the loan.

One of the great things about the Earnin cash advance is that you only have to pay back what you borrow. There are no late fees or penalties, and you can even choose to pay back your loan over time. Plus, there's no need to worry about your credit score - as long as you have a bank account, you're eligible for an Earnin cash advance.

If you're looking for a fast and easy way to get access to cash when you need it most, then an Earnin cash advance may be just what you're looking for. With no interest and no penalties, it's a great way to cover unexpected expenses without breaking the bank. So if you're in need of some quick cash, be sure to check out the Earnin website or app today.

👀 Related Article: How to Borrow Money from Cash App

Chime is one of Moneylion's competitors. The mobile banking app that allows users to open bank accounts, view account balances and transactions, and deposit checks remotely using their smartphones.

Chime also offers its users a unique feature called "Automatic Savings," which rounds up each purchase made with the Chime debit card to the nearest dollar and deposits the difference into the user's Chime savings account.

For example, if a user spends $3.75 on coffee, Chime will automatically deposit 25 cents into the user's savings account. This feature helps users to save money without having to make any additional effort. Chime also offers a "Pay Friends" feature, which allows users to send money to their friends and family members quickly and easily using their smartphones.

Chime Chime additionally allows customers to build their credit score over time by making on-time payments to Chime. The payments are reported to the three major credit bureaus, so they can help improve the customer's credit score.

This feature is available to all Chime customers, and there is no fee to use it. Customers can use the credit builder feature to help them get approved for a mortgage, car loan, or other type of loan. It can also help them get a better interest rate on those loans.

The credit builder feature is easy to use:

Finally, Chime allows users to have access to their paycheck up to two days early.

Acorns is one of the money apps like Moneylion. This app helps you invest your money. You can start with just $5 and then invest in a variety of stocks and funds. Acorns will automatically round up your purchases and invest the spare change for you. This is a great way to start investing without having to do a lot of research or worrying about picking the right stocks.

There are a number of reasons why someone might want to use site like Moneylion. Some people might want to improve their credit score in order to buy a car or house. Others might simply want to improve their credit score for peace of mind.

When it comes to finding reliable and affordable ways to build your credit, MoneyLion is one of the top apps out there. However, there are times when it can be less than reliable. Sometimes the app doesn’t work properly, and in order to use the credit builder feature, you have to pay for a more expensive membership. The following are the best loan apps like Moneylion to improve your credit rating.

Kovo is a financial technology company that offers an innovative solution to help people build their credit.

No credit check is required for approval, so you can get a retail loan instantly. Plus, there are no fees or interest rates associated with using Kovo Credit. Payments are reported monthly to Experian® and Equifax®, so you can keep track of your progress as you build your credit score.

Kovo also provides users with educational resources and tools to help them improve their credit score. Kovo is an affordable way to build your credit, and it's easy to use. Simply create an account on the Kovo website, and start building your credit today!

Kovo is also partnered with some of the leading lenders and credit card issuers in the country. When you open a personal loan, student loan, or credit card through one of these partners, you'll be eligible for rewards in the form of gift cards. Rewards are calculated as 1% of the value of the loan or credit card, so it's a great way to earn some extra spending money.

So if you're looking for an easy way to build your credit history, Kovo Credit is the solution for you. Create an account today and get started on your path to better credit!

Kikoff is an app similar to Moneylion. Basically, it is a credit account that allows you to purchase items through their store. It is a revolving line of credit, which means that you can reuse the funds once you pay your balance off. You have a $750 credit limit, which you can draw against to make purchases. This account is ideal for people who wouldn’t qualify for a regular credit card.

One thing to note about Kikoff is that all purchases must be made through their store. This has a few disadvantages. For one, their store doesn’t have as wide of a selection as other retailers. Additionally, their prices are often higher than those of other stores. However, if you are looking for a way to purchase items without having to go through a credit check, Kikoff is a great option.

If you are looking for installment loans like Moneylion you should take a look at Self.

Self Lender is a company that helps people improve their credit score. The company accomplishes this by assisting individuals in building credit histories. This is done by allowing people to borrow money, put it aside in a secured savings account or certificate of deposit (CD), and then gradually pay back that money. This helps to show lenders that the person is capable of repaying debt in a timely manner.

When someone signs up for a Self Loan, they are given a loan of between $500 and $2,000. This loan is then repaid over a period of 12 to 24 months. During this time, the person's credit score will be monitored. Once the loan has been repaid in full, the person's credit score will be improved.

When it comes to finding a safe and reliable place to store your money, Varo is an excellent alternative to Moneylion. Unlike some of the other "fintech" companies out there, Varo is a real Bank! This means that your money is insured up to $250,000 by the Federal Deposit Insurance Corporation (FDIC). In addition to being a safe place to store your money, Varo also offers some great features and benefits.

One of the best things about Varo is that there are no monthly fees or account minimums. This makes it a great option for people who are looking for a low-cost way to manage their finances. Another great feature of Varo is that you can use the app to track your spending and find ways to save money. The app also allows you to set up budgeting goals and see how close you are to reaching them.

Varo also offers a number of different ways to pay bills and send money. You can use the app to pay bills directly from your account, or you can send money to friends and family members using their email address or phone number. You can also use Varo to deposit checks remotely, without having to go to a physical bank branch.

Overall, Varo is a great option for people who are looking for a low-cost way to manage their finances. The app is easy-to-use and allows you to track your spending, set budgeting goals, and pay bills easily. In addition, your money is insured by the FDIC up to $250,000.

A recent survey found that 56% of Americans have less than $1,000 in savings. This means that a significant portion of the population is at risk of overdraft fees and other penalties from banks if they accidentally spend more money than they have in their account.

A solution would be to side hustle with a gig economy app that offers same-day pay. Payday loan apps are another option.

MoneyLion is an app that helps users manage their money. It is a comprehensive money management tool that offers a variety of features. The app is easy to use and has positive customer reviews.

When it comes to finding apps like Moneylion, there are plenty of them to choose from. But before you download any of them, it's important to understand what they do and how they work.

Most of these apps are designed to help you manage your money better. They can help you track your expenses, budget for your goals, and even invest your money. And many of them offer features like cash advances and credit builder services.

But not all of these apps are created equal. Some are more user-friendly than others, and some have more features than others. So before you download an app, be sure to do your research and find one that fits your needs.

And don't forget to read the reviews on BestReferralDriver!

Apps offer similar services, but may have different features and pricing structures. It's important to research different apps before choosing one that's right for you.

When looking for a service like MoneyLion, consider the following:

There are many benefits of using apps like MoneyLion. One of the most important benefits is that it can help you build your credit score. A high credit score can help you get approved for a loan, car insurance, and even a job. These apps can also help you avoid overdraft fees and save money on interest rates and fees.

So there you have it, our list of 9 apps like MoneyLion. We hope this gives you the information you need to make an informed decision about which app is best for your needs. If you’re looking for alternatives to traditional cash advance and loan services, any of these apps are worth checking out. Remember that the first step toward financial health is understanding your spending habits in order to determine where you need to cut back. You can do it for free by using a budgeting app such as RocketMoney. Thanks for reading!

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

How to Lock an Electric Scooter and 5 Best Locks

E-Scooter Locks