Credit Sesame Review (2024): Is it Legit, Accurate and Free?

If you're looking for a credit Sesame review, you've come to the right place. Credit Sesame is a website that offers free credit scores and reports to users. But is it accurate? Is it legit? And is it really free? In this article, we'll take a close look at Credit Sesame and see what all the fuss is about.

Credit Sesame is a financial online platform that offers users free credit scores, credit monitoring, and personalized financial advice.

It is also one of the credit building services. Indeed, using the Sesame Cash can help you boost your credit score.

The company has built a platform that provides users with a free credit report, as well as access to tools and resources to help them improve their credit rating and manage their finances. Credit Sesame also offers paid products through a paid membership, such as credit monitoring and identity theft protection.

Let’s take a look in detail at all the services offered by the company.

Credit Sesame is one of the most popular credit-monitoring services in the United States, and millions of people use it each year to get a better understanding of their credit rating and financial health.

More specifically, the company offers a free single credit bureau (TransUnion) monthly credit score and free credit monitoring. The monitoring is free of charge and does not require a credit card.

Your credit score will include the following information:

👀 Related Article: Experian Boost Review

Your credit report card will include the following information:

Credit Sesame offers a wide range of monitoring and protection services to its users. These include:

Credit Sesame is a reputable company that has been in business since 2010. Founded by Adrian Nazari, Credit Sesame has raised $171.5 million in venture capital and counts 16 investors, including the Healthcare of Ontario Pension Plan (HOOPP) and Menlo Ventures, among its backers.

Credit Sesame currently has more than 16 million users. The company offers a free credit score report and credit counseling. It also provides users with tips on how to improve their credit score, as well as how to manage their finances. The company has a five-star rating from TrustPilot and has received positive reviews from users.

Overall, Credit Sesame is a credible and reliable source of information on credit scores and personal finance. However, it is always important to be aware of the risks associated with any financial product or service, and to consult with a financial advisor if you have any questions or concerns.

One common question about credit scores is how they're determined. Many people have heard of services like Credit Sesame, which claim to be able to give you a free credit score. How do these services work, and are they really providing you with an accurate estimate of your credit score?

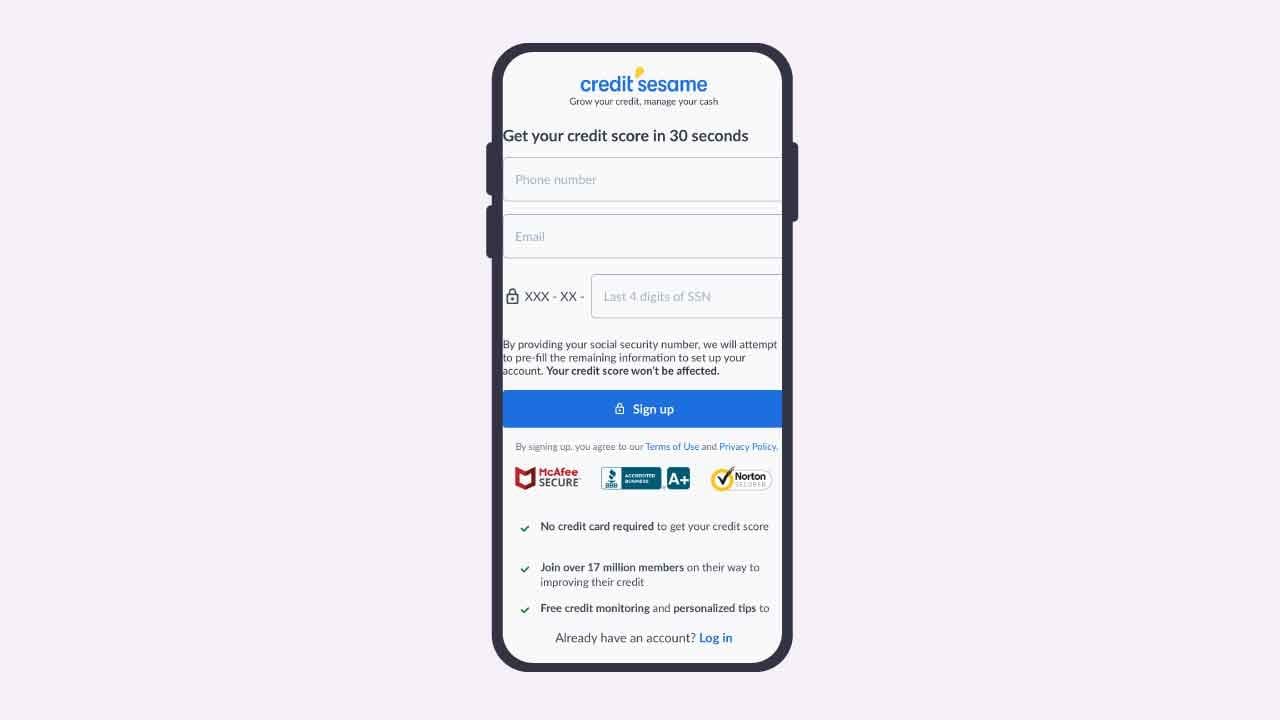

To get your free credit score from Credit Sesame, you first need to create an account on their website.

Once you've registered, the company will ask you to provide some personal information, including your Social Security number. This is because Credit Sesame uses your Social Security number to access your credit report from the three major credit reporting agencies: Experian, Equifax, and TransUnion.

After you've entered your personal information, Credit Sesame will provide you with a free credit score, as well as information about how to improve your credit score. The company also offers a number of other services, such as credit monitoring and identity theft protection.

So how does Credit Sesame work? By accessing your credit report from the three major credit reporting agencies, the company is able to give you a free credit score each month.

This score is based on the information in your credit report, including your payment history, credit and debt levels, and the types of accounts you have open.

The company is able to create a personal credit profile. This profile includes a credit score, which is updated monthly, as well as tips for improving your score.

You can use this information to make informed decisions about your finances and take steps to improve your credit rating.

If you're looking for a more in-depth answer to the question of whether or not Credit Sesame is accurate, you're in the right place.

So, is Credit Sesame accurate? That's a tough question to answer because there are so many different ways to calculate a credit score. Credit Sesame uses the VantageScore 3.0 model, which is created by the credit scoring company VantageScore Solutions. This model is used by a number of different creditors, including some of the largest banks in the United States.

However, there are other credit scoring models out there, including the FICO score, which is used by most lenders.

Additionally, Credit Sesame is not the only company that provides free credit scores. Other services like myFICO and Credit Karma also offer free scores to users. However, it's important to note that these scores may not be entirely accurate. Your actual credit score may be different depending on the scoring model used by the lender or creditor who is reviewing your application.

So it's hard to say definitively which model is more accurate - they both have their pros and cons.

That being said, Credit Sesame can be a great way to get an idea of where you stand when it comes to your credit score. And if you use some of the tips offered on the site to improve your credit score, you could see a real difference in your credit rating over time.

There are four plans available: a free plan, an advanced plan for $9.95 per month, a pro plan for $15.95, and a platinum plan for $19.95.

The free plan includes daily credit score updates from TransUnion, monthly credit score updates from all three bureaus, and monthly full credit reports from the same three bureaus.

The advanced plan includes the features of the free plan plus a credit report card from Transunion.

The pro plan includes all of the features of the advanced plan plus 24/7 live assistance in case of identity theft.

The platinum plan includes all of the features of the pro plan plus identity monitoring, dark web monitoring, and public records monitoring.

People seem to be generally happy with the service Credit Sesame provides. Their app boasts a 4.7 out of 5 star rating on Google Play and a 3.5 out of 5 rating on BBB. Most users say that Credit Sesame is easy and helpful in understanding their credit score.

A few people have mentioned that they would like more information on how to improve their credit score.

Overall, the consensus is that the site could be more user-friendly and that the customer service could be improved. One reviewer said, "I canceled my subscription because I found the website difficult to navigate and the customer service was unhelpful." Another said, "I like that it gives you your credit score for free, but there are other websites that are more user-friendly."

Credit Sesame’s Credit Builder is a unique program that can help you improve your credit score. Having good credit will come in handy someday!

When you move money from your Sesame Cash account into Credit Builder, it becomes a security deposit for a virtual Secured Credit Card the company will report to the credit bureaus. Your virtual secured credit card can help increase your overall available credit and lower your credit utilization, which can lead to a higher score—all with the cash you have.

But what bank does credit sesame use?

Community Federal Savings Bank is the financial institution that manages your account. Credit Sesame will assist you with the management and maintenance of your Sesame Cash account by providing administrative and operational services.

The Credit Builder program is designed to be simple and easy to use. You don’t need to have good or excellent credit to be accepted into the program, and there are no application fees or interest rates. You can use the Credit Builder program to improve your credit score even if you already have a secured or unsecured credit card.

So, how does a Credit Sesame credit builder work?

Your Credit Builder account will be linked to your Sesame account, and you will be able to access it anytime, anywhere. You can use your virtual Secured Credit Card for everyday purchases and build your credit history at the same time. Whenever you make a purchase with your Secured Credit Card, the purchase will be reported to the three major credit bureaus: Equifax, Experian, and TransUnion.

The Credit Builder program is an excellent way to improve your credit score without having to take out a loan or get a new credit card. It’s simple, easy-to-use, and affordable—and it can help you achieve your financial goals.

Finally, using the Sesame card you can earn cash back on thousands of local businesses and nationwide companies including Uber, Uber Eats, Apple, Samsung, Walmart and more.

Contacting Credit Sesame Customer Service is easy! You can reach them by phone, email, or even by mail.

To contact them by phone, simply call 1-877-751-1859 and a customer service representative will be happy to help you. They are available 7 days a week.

If you would prefer to contact them by email, you can do so by opening a ticket. Be sure to include your name, account number, and a brief description of your issue.

If you would rather speak to someone in person, you can send a letter to:

Credit Sesame Customer Service

444 Castro St., Suite 500

Mountain View, CA, 94041

When it comes to credit scores, there is a lot of misinformation out there. So, does Credit Sesame hurt your credit?

The answer is no – signing up for a Credit Sesame account will not affect your credit score. In fact, the platform will conduct a soft credit inquiry which can actually be helpful in keeping track of your credit score and identifying ways to improve it.

However, applying for one of the recommended products on the platform could result in a hard inquiry. A hard inquiry occurs when a lender checks your credit score as part of the application process and can temporarily lower your credit score by a few points. So, while Credit Sesame won’t hurt your credit score, be aware that applying for products through the platform could result in a hard inquiry.

Yes, sesame cash helps build credit. In fact, it's one of the most popular ways to do so. When you use the sesame cash debit card to make purchases, you're essentially borrowing money from the credit card company. This then impacts your credit score in a positive way, as it shows that you're responsible with borrowed money. Over time, as you continue to use sesame cash and make on-time payments, your credit score will increase. This means that you'll be able to access more affordable loans and credit cards in the future.

Credit Sesame is a safe, legitimate and accurate credit score provider. The service is free to use, and you can get your credit score updated as often as once per month. If you are willing to pay, you can also use Credit Sesame to monitor your credit report for changes, which could indicate identity theft or other fraudulent activity. Thanks for reading our review of Credit Sesame! We hope this information has been helpful and that you will consider using their services in the future. If you want to improve your credit score, do not forget to read our Kovo and Kikoff reviews .

We provide the best resources and information for the major ridesharing, bike sharing, kids sharing and delivery companies. Best Lyft driver Promo code and Postmates Referral code. Sign up at 100% working and they will give you the best sign up bonus at any given time.

How to Lock an Electric Scooter and 5 Best Locks

E-Scooter Locks